|

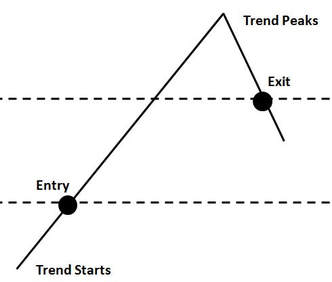

Shoot the fireworks and uncork the champagne, this current bull phase is now the second longest in history at 107 months! Our course everybody celebrates number two right? We’re #2! We’re #2! I am sure you heard this chant at the last Florida vs. Florida State game, right? (sarcasm) Think about it! The longest expansion in history was 120 months from March 1991 to March 2001. This current expansion has just slipped into second place in the history books at 107 months (106 months was the previous second best). How much longer can it goes is a great question to ask? However, the Gambler’s Fallacy (not that this is gambling after all its investing) is assuming previous results will change future results. As an example, “I have run this 50 times, so it must be likely to drop now.” And it really feels like it should be that way. But it's not any more likely on the 50th run or the 500th run. Are markets random as in the flipping of a coin or are they as much about the underlying fundamentals of a given time period or market? One could argue either way! I would personally argue it doesn’t matter. You take what the market wants to give you whether that is 120+ months and a new record long expansion cycle or 107 months and then straight off a cliff. Forecasting is a losers game! Instead, we propose you should be ready to react to confirmation that something has changed. This is the fundimental tenant of trend following, an investment strategy woven into every portfolio we run at InTrust Advisors. Trend following is agnostic as to the direction of the markets, up or down. In fact this chart could just as easily be inverted for the trend follower.

If you remember back to the last major bear market the thing that crippled most investors was indecision. Do I stay in or get out? Most investors just froze and did nothing and rode the market to its lows. Yes, it recovered, but it took five long years to do so! A great many trend followers instead had 30-50% positive performance years in 2007-2008. How would that have affected your portfolio? We have solutions to give you or your client’s a great chance to continue making money as long this market wants to keep setting endurance records. At the same time, we have the tools and experience to keep them from the worst of what may come at any flip of the coin! Why not schedule an appointment with us today?

0 Comments

I recently started binge watching AMC's Mad Men on Netflix after finishing all of season four of House of Cards in less than a week. Mad Men is set around the late 1950s and early 1960s and follows the rather torrid, high pressure lives of Madison Avenue advertising firms. The shows main character, Don Draper, in season one received a raise from his firm from $30,000 per year to $45,000. Now being the boring financial type, my mind immediately wondered how inflation, or the increase in price levels, had affected Don's salary and what that would equate to in today's dollars. Fortunately, I did the math for you. The actual average inflation rate from 1960 - 2015 was 3.85% per annum according to the Bureau of Labor Statistics (BLS). If we assume his raise occurred in 1960, Mr. Draper's salary would be almost $360,000 in today's dollars. Now I have been to Manhattan many times and I can tell you that $360,000 does not go very far there now. However, my point is that inflation robs us of our purchasing power and governments love inflation and not so much its ugly cousin, deflation. Since governments love inflation, we must keep an eye on inflation. Fixed income or bond investors are the most at risk as their income stream is usually discounted by inflation to determine the value of today's money in the future. Inflation is what motivates equity investors to take risk in hope of higher returns. Where the bond investor is mostly just trying to protect capital and stay up with inflation after taxes, the equity investor is hoping that additional risk taking translates into additional returns up and above inflation and taxes. Of course as we have seen over the past decade or more there is no guarantee that this goal is achievable. So the bottom line here is that although Mr. Draper's theoretical salary may have risen, I would guess that Mr. Draper would tell you his salary today just "does not buy what it used too." As investors, we must realize that inflation can have a very real effect on our financial dreams and goals. We must work hard to position ourselves and our portfolios to at least stay up with the change in inflation. For those not yet in retirement, we must also realize that saving (or adding to our portfolios) tilts our chances of achieving those goals and dreams in our favor as depending on investment returns alone to outstrip inflation and taxes is not a game that everyone wins! By the way, April 15th is fast approaching! There is still time to add to your retirement savings and lower your 2015 taxes ahead of the April filing deadline. Let us know if we can help. In a perfect world, returns would always be up and returns would be highly stable.

As I like to joke, “I can’t wait to go to Heaven someday where markets always go up for advisors.” Unfortunately, this earth is not heaven and we must deal with the realities that markets don’t always go up as expected and where volatility of investment returns is the norm. So with that in mind, here are Three things to ponder when you review your investment statements this month: First, focus on your goals, not your returns. Your long-term goals are why you invest in the first place so focus on whether you are progressing towards those goals and not on whether you kept up with the S&P 500 or NASDAQ Indexes. Second, realize that being diversified can actually hurt your returns in some markets. This is one of those markets where being diversified is actually hurting investors as a narrow group of stocks are really driving most returns for the major indexes. However, also realize when a narrow group of stocks is driving market returns this is not healthy and this usually signals we are in the final innings of this up move for the market. In the future, you will be glad to be diversified as those who chased performance in these few stocks get their heads handed to them. Third, not all ways of managing money do well all the time. Institutional investors know this and therefore include differing styles of money management in their portfolios. As an example, actively managed portfolios have struggled with the Central Bankers’ constant intervention in the market. The danger is that you start chasing investment strategies that rely on Central Banks continuing to intervene in the markets only to see them exhaust their monetary tools or even back away from their support. It’s not easy to make money today! Patience and a long-term focus is required. However, if you can stay the course, you will be rewarded! Please let us know if we can help you stay focused on the goal. We offer a free Second Opinion if you think you may be off course. |