|

Throughout history there have been marriages or partnerships that have been purely for convenience. Members of royal families across Europe were wedded to each other to strengthen ties, peace, safety, or political insights. Some of the most famous marriages of convenience were:

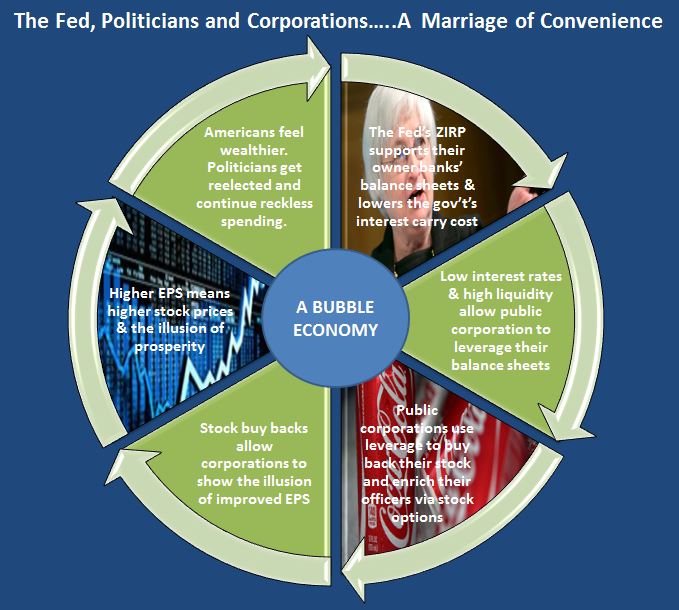

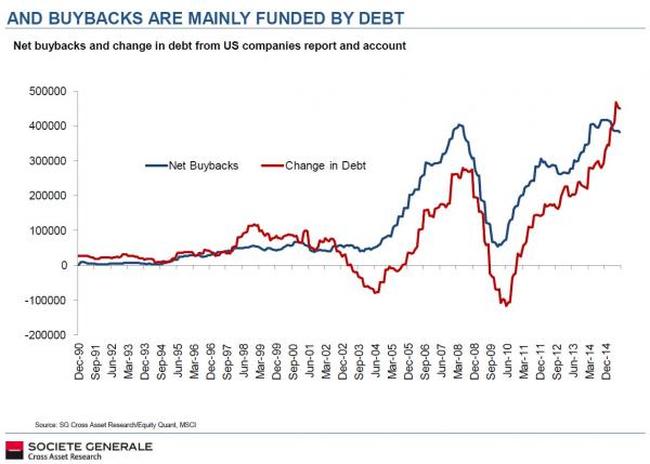

Today in the U.S. we have another kind of marriage of convenience. In fact ours is a threesome! Ooh La La! That is the marriage of the U.S. Central Bank, the Politicians and the large public corporations. That marriage goes something like this: In this Marriage of Convenience, the Federal Reserve is a key player providing liquidity by printing dollars and keeping rates at or near zero. These low rates allow U.S. public corporations to leverage their balance sheets and then to use the leverage to buy back their stock in the public markets. These buybacks, according to ZeroHedge.com, accounted for $561 billion in U.S. Equity purchases in 2015. In an article by entitled "With Everyone Selling Stocks, Who Is Buying?" ZeroHedge.com makes the point that the main buyer right now is Corporations under buyback plans. These stock purchases have pushed up or at least supported stock prices (along with the Central Bank programs to pump liquidity into the markets and repurchase bond holdings). This in turn has allowed corporate executives to meet certain pay package objectives for earnings per share and stock price and reap rich rewards.

The corporate buybacks have allowed those Americans with investment assets to "feel wealthier" despite the fact than many are not. This wealth affect has allowed politicians to continue to operate with impunity while leverage our futures with continued deficit spending and ever increasing national debt to GDP levels. Oh by the way, these politicians are supported through campaign contributions by these corporate CEOs (which also include the bank CEOs). Finally back to the Federal Reserve to compete the cycle. They have been given continued authority over our financial system and the green light by these same politicians to keep interest rates artificially low. You don't really think interest rates need to be this low to keep us from a decline in the business cycle do you? Interest rates are low because it benefits the Federal Reserve's owner banks. They can take even more risk with low cost capital to attempt to profit for their executives and shareholders. This Marriage of Convenience doesn’t benefit us. It benefits the Federal Reserve member banks, the Politicians and the Corporate CEOs. Each will continue to push the cycle further along until it cannot be pushed any further and ultimately bursts. The losers in this process are clear: 1) Retirees who must lower their standard of living to match historically low yields on their retirement assets; 2) The middle class who are being burdened with higher and higher tax and regulatory burdens to support the continued debt bubble; 3) The bank depositors who will pay the ultimate price when this cycle crashes to an end under the new “Bail-in” rules. 4) Our children (and their children) who will be paying for this debt binge the rest of their lives and into their grandchildren's; 5) Our founding fathers who must be rolling in their collective graves at the fact that the people are no longer represented in this process, just the greed and needs of the few. It may also soon effect each of us as the stock market bubble that started in 2009 may soon pop. Zero Hedge reported: "A big move is coming in the S&P 500 and it will take everyone’s breath away." They went on to report "This is a big battle for control. On the one hand fundamentals and technicals suggest a breakdown of size may well be in the cards, while on the other hand, continued "highly accommodative” central bank policies coupled with perhaps an incremental relative improvement in earnings....." The big question is then can this Marriage of Convenience continue or will they lose control of this business cycle and be headed for a messy break up? No one knows the answer for sure. The parties involved have already driven this market much higher and further than we would have ever imagined! The only thing we do know is to be careful (i.e. practice risk management) and that this present debt bubble cannot last forever (which is when risk management will finally provide its reward again).

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |