|

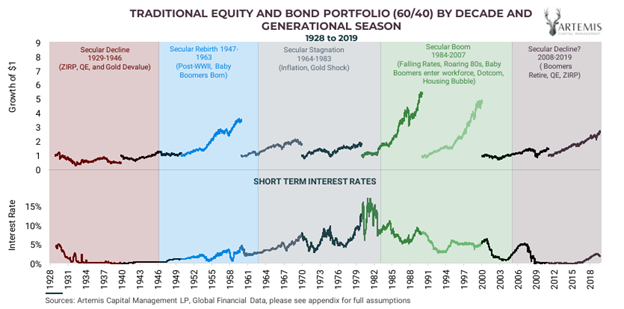

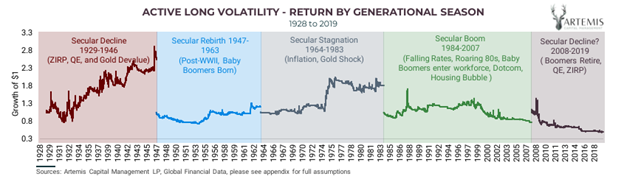

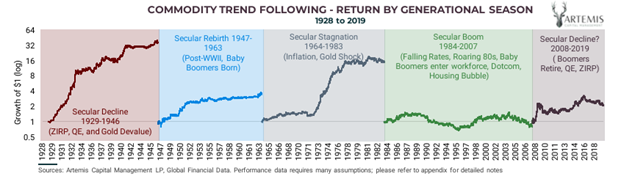

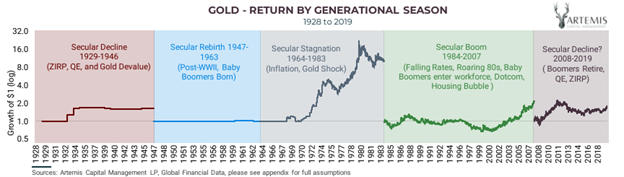

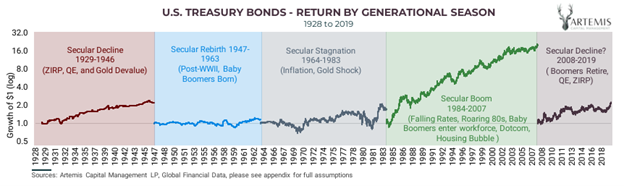

Does it seem like the world has gone crazy? Just recently, we have witnessed Russia invade another sovereign nation in real-time and the coordinated response of just about every other nation on earth to that act. The poor people of the Ukraine I believe would argue that response has fallen woefully short, but that is an article for another day! Maybe you recently had a family gathering where some poor sole (usually me) brings up the wrong issue at the wrong time (usually politics or religion are good bets) and the entire event devolves into a war of words and hurt feelings. When have we been more divided and unwilling to meet in the middle? How about the truckers in Canada? In free societies, you should be able to voice your displeasure with your government that is supposedly “for the people and by the people” or I assume that should be the case in Canada. However, instead those truckers were arrested, and their trucks and assets confiscated for expressing those same freedoms! I repeat, “has the world gone crazy?” In my study of past market history, it appears to me that we have entered a cycle or war and conflict like the early part of the twentieth century. This is a change from the last 40 years of relative calm! We have blown financial bubbles about as far as we can blow them. We have rewarded the rich and punished the poor and middle class. We have dug ourselves under levels of debt never before seen and now is the painful time in history where these secular excesses must be righted. For Americans, this last happened in the late 1920s and early 1930s and resulted in the Great Depression and the Stock Market Crash of 1929. Are we looking at the same risks today? Some call this period in long-term cycles, the Fourth Turning, as outlined in the book by the same name by Strauss and Howe. The Fourth Turning is a Crisis. This is an era of destruction, often involving war or revolution, in which institutional life is destroyed and rebuilt in response to a perceived threat to the nation's survival. Notice that institutional life is destroyed (code for turned upside down) and rebuilt (code for painfully restructured). As investors, we must realize this period can seem apocalyptic, but it is also full of opportunities, but we must change our institutional processes and cannot stay stuck in what worked the last forty years. We must adapt! A frequently referred to white paper by Artemis Capital Management entitled The Allegory of the Hawk and Serpent did a great job of identifying these cycles and what worked historical over the past 100 years through all cycles. They called this Fourth Turning “the Hawk” in the white paper and identified it as the end of a corrupted growth cycle. They called it a period “where extremes exist including a deflationary path, whereby an aging population leads to low inflation, faltering growth, a financial crash and then debt default.” Further, they highlight that this path “might be followed by an inflationary period, with fiat default, and helicopter money.” Neither path is, they say, mutually exclusive, and they claim they occur sequentially. In their analysis, they called these periods “Secular Declines.” Some say a picture is worth a thousand words, so let’s see what worked in these periods. Let’s start with interest rates (i.e., Fixed Income) and equities (the institutional processes of the past 40 years). The period of Secular Decline is on the far left and it has begun on the far right, according to Artemis Capital Management. What you can see is equities produce meager returns over the complete cycle compared to other cycles and historical averages for returns. Interest rates stay so low they don’t reward investors at all. In fact, after factoring in inflation they were likely negative real rates (i.e., yields less the rate of inflation). I would also speculate that passive management of assets is also bound to underperform during these periods due the rise in volatility (outlined below). If rates were to stay as low as in the 1929-1946 period, fixed income (i.e., bonds) would also be traded and I would argue alternatives found for some of that allocation. Artemis makes the case that volatility picks up and interest rates start to rise, while valuations must fall for equities in Secular Declines. This all seems pretty basic when you consider that equity valuations have never been higher, interest rates have rarely been lower, and volatility died during the past decade and only recently has it started to rear its ugly head again. Artemis then shows what has worked during Secular Declines. I don’t believe this means buying and holding the Volatility Index or VIX, but rather the active trading of volatility spikes by buying low and selling high and the reverse for those who can short. When I came into the business 25+ years ago, commodities were part of most portfolios. It is amazing how poorly they performed since 1984 and how recently we have witnessed a resurgence in such holdings. Could this be the start of a new commodity super cycle as was the case in 1927 to 1946? Gold, likewise, has been pretty quiet the past decade or two. We are just now seeing gold and precious metals starting to perk up. Could this be a time for them like the Secular Decline of 1929-1946 or more probably 1964-1983 when there was rampant stagflation? I reference the latter because the former was dominated by the peg of gold to a price of $35 per ounce as it was a very important part of the monetary picture. Today, gold does not back any currencies that I am aware, and it is more of a hedge against on unsound budgets and fiat currencies. Finally, we have Treasury Bonds, which did surprisingly well. I believe you can point to the exceptionally low interest rates during the 1929-1946 period for that result. I personally believe fixed income must be traded in the current Secular Decline. Held when rates fall and traded out of or hedged when rates rise.

Unfortunately, no two periods of time are exactly the same or you would just buy the four asset or asset classes above and be set. But no, it takes a keen knowledge of the past and I believe a quicker finger today to move to the right places, especially during periods of institutional destruction like we are experiencing at present. This is where we come in, we can help you survive and maybe thrive. We have both active and passive solutions that we combine into total solutions for clients. Our passive solutions include alternatives in the areas outlined above plus more traditional holdings. Let us know if we can help.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |