|

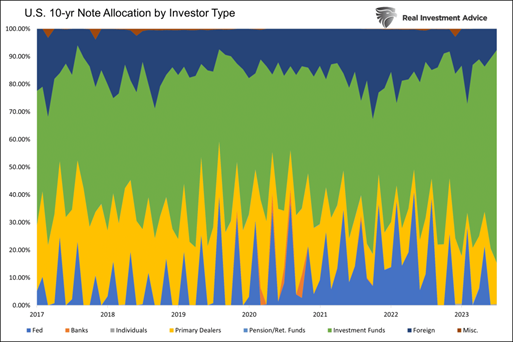

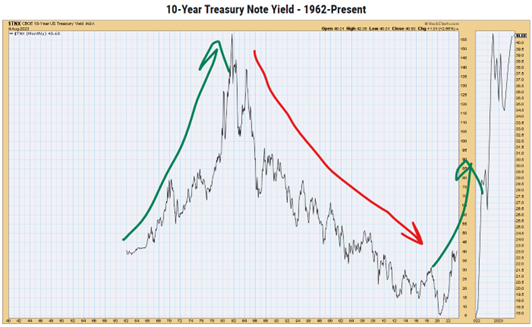

This is a very complex Macro environment due to Federal Reserve interventions, Government stimulus programs and fuzzy economic numbers that reflect the will of the party in power in Washington. Quite frankly, the last ten months for me have been very challenging. It was only recently that I stood back and tried to take a much longer, big picture view of the Macro landscape here in the U.S. that I think will frame how we tactically manage money for the next decade or more here at InTrust Advisors. What is that framework? Here it is: No. 1. The U.S. Government cannot repay its debt and lacks the will to do so. No. 2. The elected leaders in Washington will continue to print money, grow the size of the national government, and raise the U.S. debt levels because the alternatives (balanced budgets, debt repayment, downsized government, etc.) are just not something they want to stain their term in office and ability to seek reelection! No. 3. Due to weak wills and misplaced objectives, the U.S. will have no choice but to inflate away its debts. It will not risk default, nor will it move away from the path of bigger government and more for all. No. 4. Traditionally foreigners have been big U.S. Treasury buyers. No longer, they are headed down the same path or they are seeking to separate themselves from the dollarized world and they will not be big treasury buyers going forward as you can see in the chart below. No. 5. The U.S. Government cannot allow interest rates to continue upward. The interest carry will continue to compound and become just too big a part of the U.S. budget. No. 6. The Federal Reserve will be the only big buyer of treasuries and that means currency debasement to do so (i.e., a falling dollar). This debasement may be hidden by a race for the bottom with other countries and currencies, but I think this is a race we will win! No. 7. The U.S. will use financial repression to debase its currency in a controlled fashion. However, it could spiral out of control and lead to runaway inflation. Financial repression is a term that describes measures by which governments channel funds from the private sector to themselves as a form of debt reduction. Financial repression here could be paying a return on treasuries that is less than zero after adjusting for inflation whereby they slowly rob citizens of purchasing power to lower debt levels in nominal terms. No. 8. U.S. residents could become U.S. treasury buyers in retirement plans or pensions. This will be sold to us as a way of protecting retirement savings but really would be about finding a home for this ever-increasing pile of debt. Japan’s citizens do this willingly. It’s likely here in the U.S. this will be legislated upon us. No. 9. Treasuries will no longer be a store of long-term value. They will need to be more actively managed and over time will lose some of their luster as rates are held down while inflation rises (i.e., financial repression). Also 40 years of falling interest rates has led to a fixed income being a larger part of every portfolio, rising rates over the next few decades will do just the opposite. No. 10. Gold, commodities, and hard assets will once again become important holdings for Americans. The diversification of holdings into more than just stocks and bonds will become increasingly important. In summary, we are on the verge of a shift in our country’s financial outlook like we have not experienced in many years. The last such period was probably the late 1960s and 1970s. This may seem like gloom and doom but for every challenge there are opportunities as well! Let us know if we can help you unlock those opportunities. Disclaimer: This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisers before engaging in any transaction.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |