|

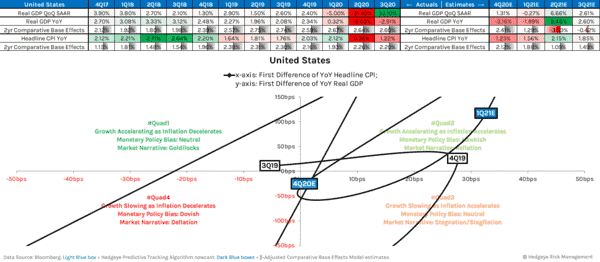

Just a few weeks ago, the headline risk was all negative. The narrative was that Covid-19 was spreading throughout the world in a second wave. Countries were closing down again. Would the U.S. be next to close down like in early 2020 and it was rumored this would most likely happen with a Biden win? Speaking of the Presidential Election, the main-stream media did a pretty good job of fear mongering regarding that election. What if Trump won? Would there be rioting in the streets and general unrest? The narrative went that such unrest could be very negative for your portfolio and for America! Turns out the Trump has not won (at least not yet as he pursues legal action in various swing states). Instead, Joe Biden appears to be the overwhelming favorite to assume the role of President come January. Then recently, Pfizer announces a possible vaccine for Covid-19 with 90% effectiveness. Stocks of course are rallying like there is no tomorrow on the news and breaking to fresh highs clearing technical hurdles that just a few days ago we thought might lead to a market reversal. The cynic in me wonders if Pfizer had a possible vaccine prior to the election but waited until Biden’s win to announce the trial effectiveness, but I digress. Maybe it’s just me, but it seems the good news is now coming in batches. No matter the reason, my point here is that the market will do what it wants. It is an untamed animal that requires it be followed, not forecast. Why Forecasting Doesn’t Work? Have you noticed how many guests on CNBC are clamoring to give their market forecast? The reason is that it cost them nothing to do so, but if they are lucky enough to get it right, it could change their standing forever. As I think back over time, I can remember a CNBC guest named Elaine Garzarelli. She was credited with calling the bottom of the 1982 and 1984 Bear Markets and the top of the 2000 Bull Market. However, where is she today? I don’t even know. You rarely see her anymore on any news channel. I can tell you it’s pretty hard to get the calls consistently right or we would hear more from or about her. The constant flow of news and changing market conditions is what makes forecasting markets so tough. As an example, we have been using a service called Hedgeye to provide us fundamental data on global economies and the markets. The founder of this group is a pretty brash guy named Keith McCullough. He and his group are constantly updating their subscribers on the economic quad that they believe the data is telling them that we are entering. Mr. McCullough bad mouths the Old Wall and investors who see the markets differently. However, like Elaine Garzarelli before him, the constant change in the market narrative, the amount of market control now exercised by global Central Banks and the monetary policy (stimulus) that governments keep implementing has made their forecasts all but worthless. We recently cancelled our agreement with them as a result. The Key to Success We continue to believe the key to success is to follow the market until it tells you the trend is reversing. We call this Trend Following and it is something that is built into every portfolio we run. It is not perfect, and we usually give up some upside and give back some profits waiting on the signals. However, it is a discipline and allows us to stay focused on the trend and not the short-term noise.

We like it for a number of reasons:

This latter point I believe is one of the most important. When the election approached, our models had us reduce exposure, which is good money management. However, those same models did not have us out of the market. Now that the market is rallying again, we are participating in the rally and not sitting on the sidelines. Had some of the doom and gloom occurred that we mentioned previously, we would have limited downside risk. We may now be underperforming on the upside as we look for the right time to possibly add back some exposure, but we did what our clients pay us to do and that is to “manage risk” first and foremost and generate positive returns as a secondary goal. Maybe our process could help you? If so, please click here for a free consultation.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |