|

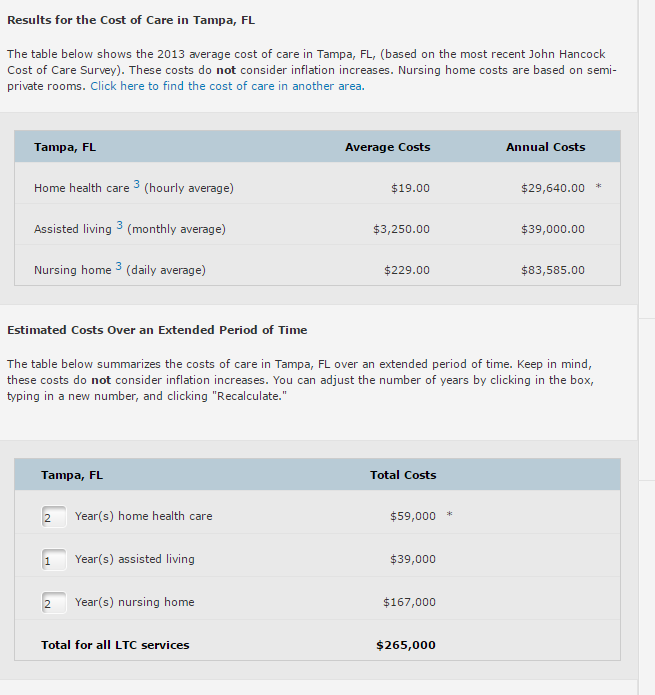

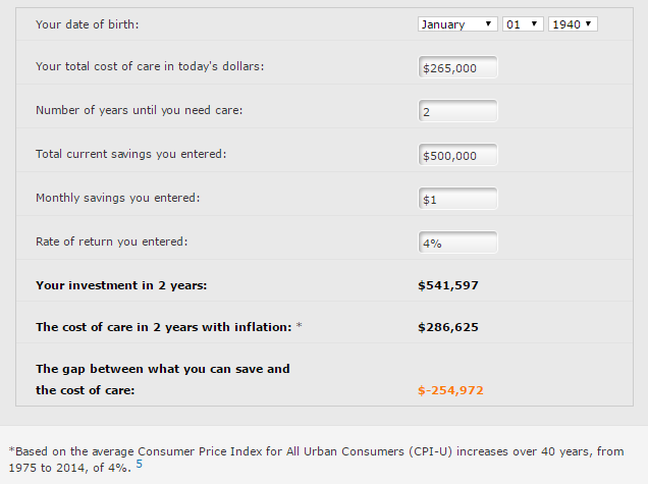

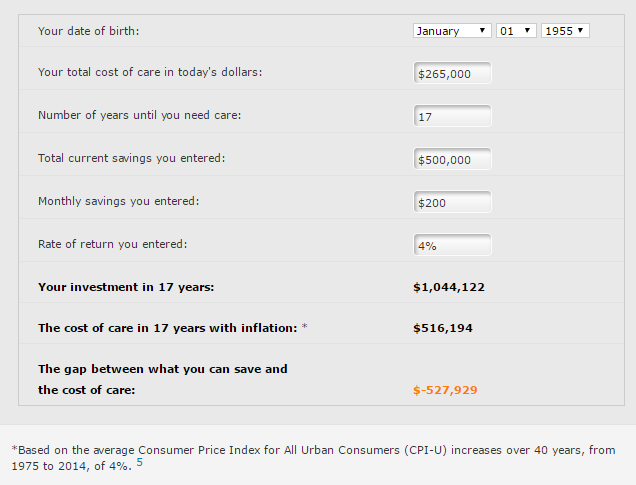

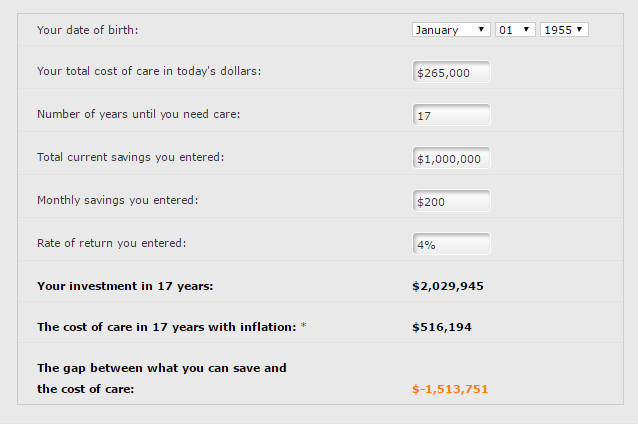

As we have discussed on this blog before, the need for long-term care is substantial and growing in this country, especially as we continue to age as a population. Here in my opinion is one of the most startling statistics related to long-term care: So roughly a 50/50 chance that you will at least spend some time in a assisted care facility! Not bad odds. Apply that to a couple and the odds that one or both will need assisted care help become much closer to 70% for those over age 65 according to the Centers for Medicare and Medicaid Services (2015 Medicare & You). That would not be so bad except for one thing: Medicare does not pay for long-term care services as explained by the Social Security Administration: “Social Security pays retirement, disability, family and survivors benefits. Medicare, a separate program run by the Centers for Medicare & Medicaid Services, helps pay for inpatient hospital care, nursing care, doctors’ fees, drugs, and other medical services and supplies to people age 65 and older, as well as to people who have been receiving Social Security disability benefits for two years or more. Medicare does not pay for long-term care, so you may want to consider options for private insurance (emphasis added).” So how much does long-term care cost? Well that depends on the city or state you live in and the amount of such care needed. The Centers for Disease Control and Prevention, Nursing Home Care FastStats - May 2014 stated that the average length of a nursing home stay is 835 days—or more than two years. Obviously that is an average meaning some will have much longer stays and some will have no stay at all. That same FastStats report stated that a median daily rate for such care was $240 nationally. So for an average nursing home stay of 835 days that means current costs are over $200,000. (By comparison, the average hotel room is just $121/day!) So this is no small cost and it is quite frankly not affordable for many Americans! The Federal Long-Term Care Insurance Program has a great website and based on my city using their Cost of Care Tool, here is what such care could cost in Tampa, excluding any inflation increases: Again no small cost for the average American! So the obvious question for most families is can I self fund or self insure this possible liability? The answer is common sense as this really is a means test. It will be much simpler for a multi-millionaire than a retired government employee living on a fixed pension and/or social security to afford to self insure this potential liability. The Federal Long-Term Care Insurance Program site gives us a tool to look at these costs in relationship to our savings, called the "Self Funding Tool?" As an example, if you are 76 years old already and at least partially living on savings, look what such costs can do to your retirement nest egg if just one spouse needs long-term care at age 78, assuming they live in Tampa and are no longer adding to their savings. Wow that is pretty big hit! Over one-half the nest egg disappears over that period of care. What happens if you are lucky enough to be a bit younger and save $200 per month but otherwise have the same assumptions? So you can see that with inflation rising at about the same rate as investment returns in this scenario, the cost of long-term care really takes a bit out this couple's retirement nest egg. Finally, let's take a look at the rather obvious conclusion of adjusting the above assumptions for a greater starting nest egg of $1.0 million. As you probably guessed, this is still a large cost, but it does not have nearly the impact on this couple's retirement depending of course on their lifestyle in retirement.

So what is the answer? As you have probably guessed, if you are approaching your mid 50s or early 60s and you are not a millionaire today, you need to think about long-term care insurance. This cost is just to great ignore otherwise. There are lots of long-term care options today including tying such potential care liabilities to a hybrid life or annuity policy whereby, should you not need such care, your heirs will benefit from a larger life insurance payout or you may benefit from more annuity dollars in your retirement. Let us know if we can help you figure this out.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |