|

I recently started binge watching AMC's Mad Men on Netflix after finishing all of season four of House of Cards in less than a week. Mad Men is set around the late 1950s and early 1960s and follows the rather torrid, high pressure lives of Madison Avenue advertising firms. The shows main character, Don Draper, in season one received a raise from his firm from $30,000 per year to $45,000. Now being the boring financial type, my mind immediately wondered how inflation, or the increase in price levels, had affected Don's salary and what that would equate to in today's dollars. Fortunately, I did the math for you. The actual average inflation rate from 1960 - 2015 was 3.85% per annum according to the Bureau of Labor Statistics (BLS). If we assume his raise occurred in 1960, Mr. Draper's salary would be almost $360,000 in today's dollars. Now I have been to Manhattan many times and I can tell you that $360,000 does not go very far there now. However, my point is that inflation robs us of our purchasing power and governments love inflation and not so much its ugly cousin, deflation. Since governments love inflation, we must keep an eye on inflation. Fixed income or bond investors are the most at risk as their income stream is usually discounted by inflation to determine the value of today's money in the future. Inflation is what motivates equity investors to take risk in hope of higher returns. Where the bond investor is mostly just trying to protect capital and stay up with inflation after taxes, the equity investor is hoping that additional risk taking translates into additional returns up and above inflation and taxes. Of course as we have seen over the past decade or more there is no guarantee that this goal is achievable. So the bottom line here is that although Mr. Draper's theoretical salary may have risen, I would guess that Mr. Draper would tell you his salary today just "does not buy what it used too." As investors, we must realize that inflation can have a very real effect on our financial dreams and goals. We must work hard to position ourselves and our portfolios to at least stay up with the change in inflation. For those not yet in retirement, we must also realize that saving (or adding to our portfolios) tilts our chances of achieving those goals and dreams in our favor as depending on investment returns alone to outstrip inflation and taxes is not a game that everyone wins! By the way, April 15th is fast approaching! There is still time to add to your retirement savings and lower your 2015 taxes ahead of the April filing deadline. Let us know if we can help.

0 Comments

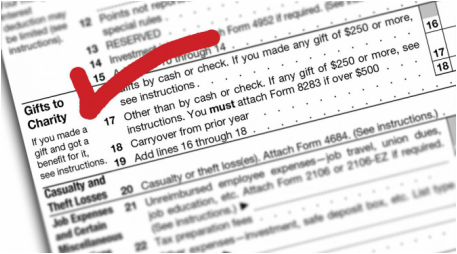

In case you missed it, Congress in late December permanently extended the exclusion from income of up to $100,000 per person per annum of Individual Retirement Account (IRA) distributions given directly to qualfied 501(c)3 charities for those already over the age of 70 1/2. n

This popular exclusion lets a taxpayer give to charity directly from their IRA, treat the distribution as part of their Required Minimum Distribution for the year and avoid tax on that distribution. The downside is you don’t get an itemized deduction for the charitable gift and you cannot receive anything in return for the gift from the charity as quid pro quo for your contribution. There are a few other restrictions such as the gift cannot go to a donor advised fund, private foundation or supporting organization. Also you cannot make the gift from a Simplified Employee Plan (SEP) or a Savings Incentive Match Plan for Employees (SIMPLE plan) if an employer contribution was made that year. Who is this be best for? Anyone who wants to give cash to a charity. What would possibly work better? The only one we could think of was a gift of appreciated property whereby you avoided the capital gain on the gift to charity. For more information, check out this article on Forbes/Personal Finance. |