|

In case you missed it, Congress in late December permanently extended the exclusion from income of up to $100,000 per person per annum of Individual Retirement Account (IRA) distributions given directly to qualfied 501(c)3 charities for those already over the age of 70 1/2. n

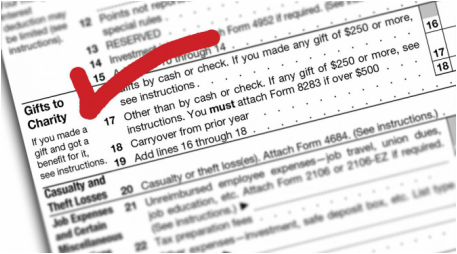

This popular exclusion lets a taxpayer give to charity directly from their IRA, treat the distribution as part of their Required Minimum Distribution for the year and avoid tax on that distribution. The downside is you don’t get an itemized deduction for the charitable gift and you cannot receive anything in return for the gift from the charity as quid pro quo for your contribution. There are a few other restrictions such as the gift cannot go to a donor advised fund, private foundation or supporting organization. Also you cannot make the gift from a Simplified Employee Plan (SEP) or a Savings Incentive Match Plan for Employees (SIMPLE plan) if an employer contribution was made that year. Who is this be best for? Anyone who wants to give cash to a charity. What would possibly work better? The only one we could think of was a gift of appreciated property whereby you avoided the capital gain on the gift to charity. For more information, check out this article on Forbes/Personal Finance.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |