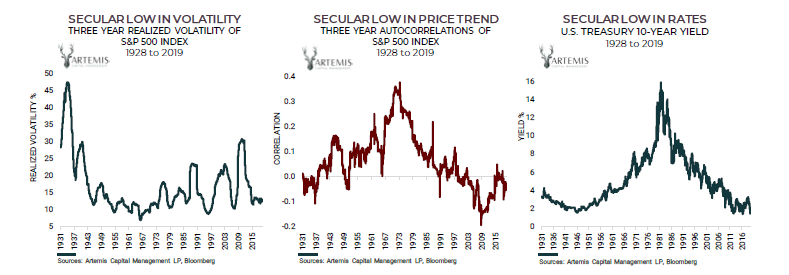

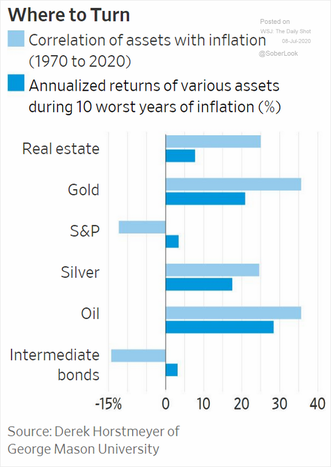

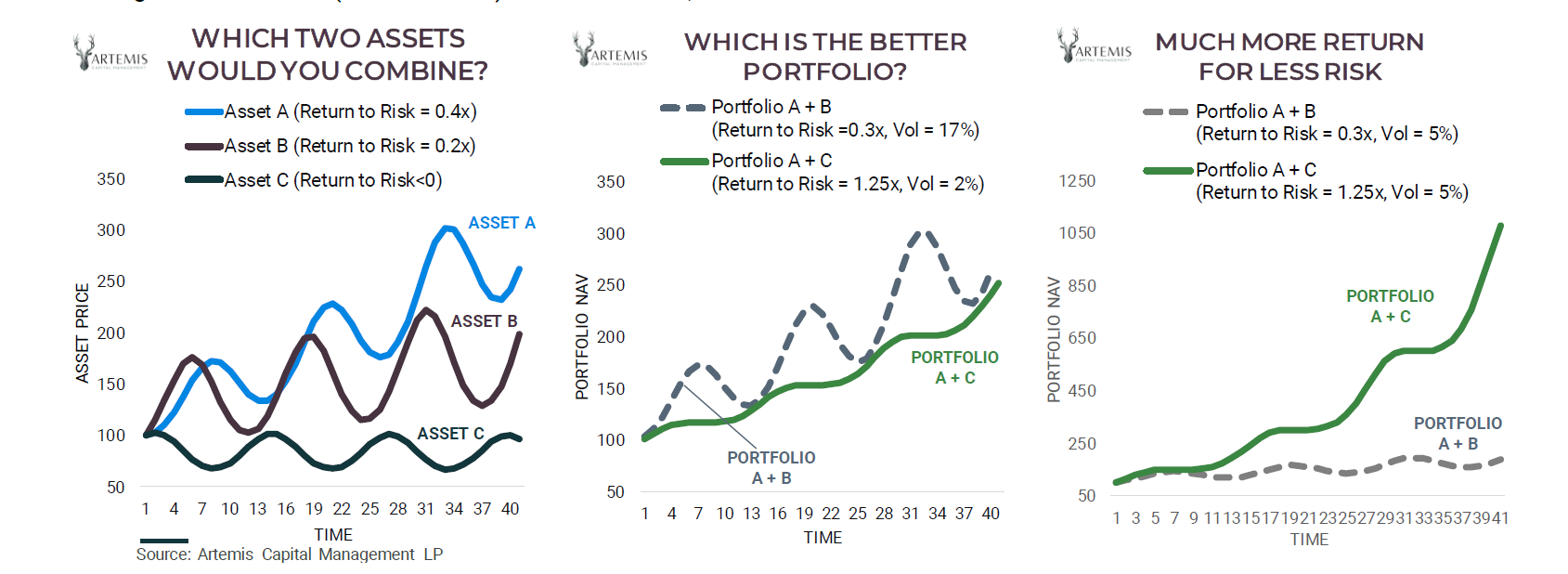

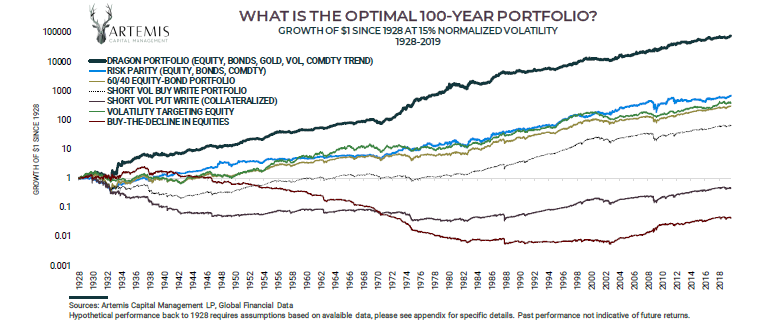

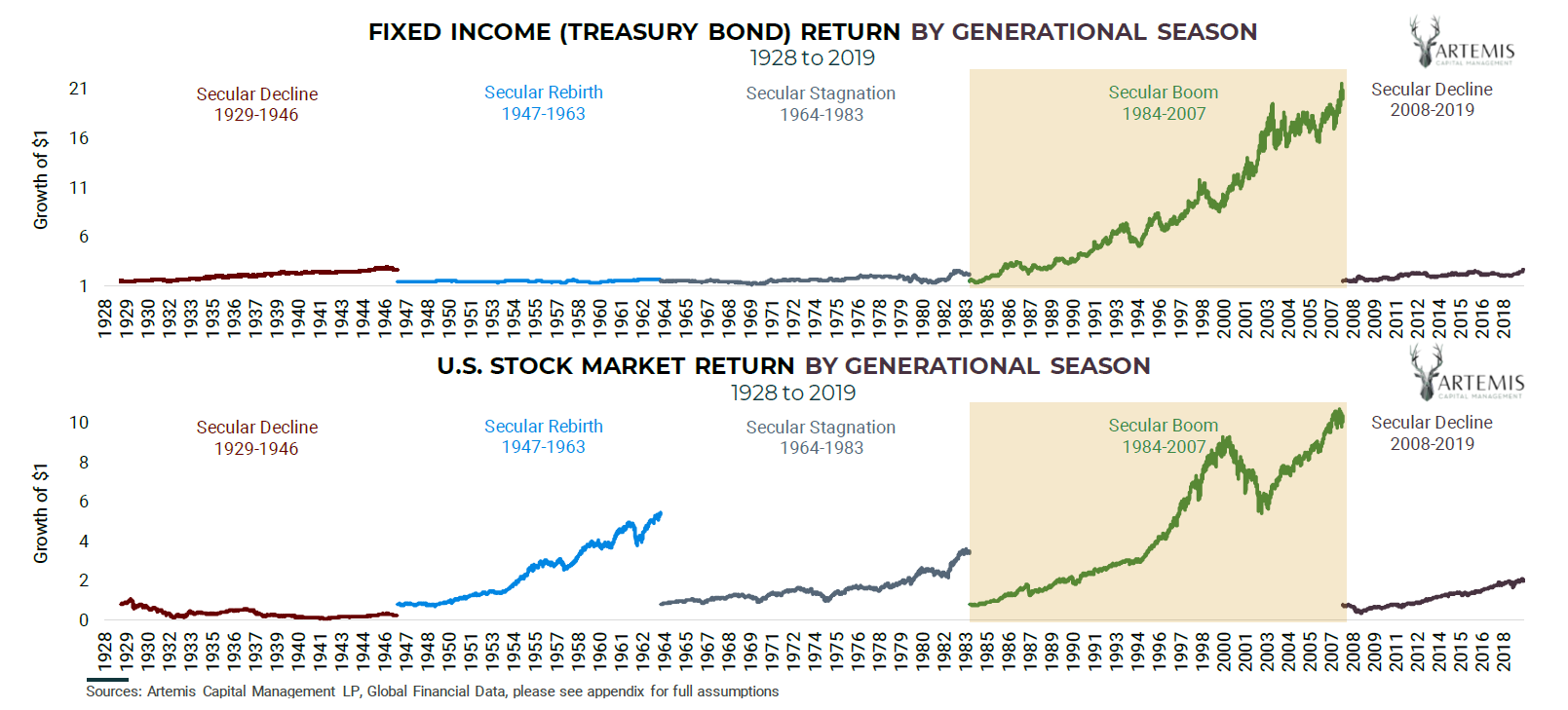

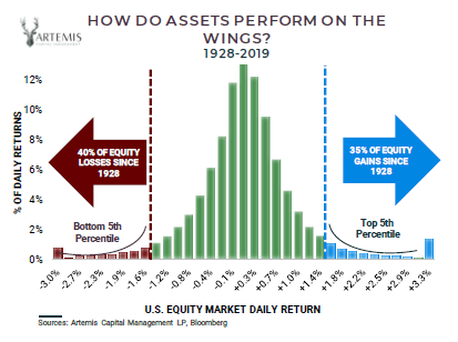

If you are like me, you have probably been rubbing your eyes, cocking your head to the side and looking perplexed. No amount of CNN or Fox News, depending on your political perspective, can sooth the gnawing feeling in your stomach that something is not right, something has changed! Our founding fathers regularly gathered at taverns to discuss the politics of the day. There were surely differences of opinion, but somehow, in most cases, they were able to discuss those differences and agree to disagree. But not today, we are strongly divided today, and it appears to me there is little tolerance for opposing points of view. It is “my way or the highway buddy!” The pandemic has not helped as it is now harder than ever to meet and gather to discuss the news of the day without of proper mask or social distancing. Even the favorite meeting places of our founding fathers (the local bar or tavern) are now closed or only partially open due to the virus. Life has certainly entered a “New Normal” or paradigm and it’s much more stressful, at least to me. However, what seems like chaos is really part of God’s bigger plan and the changes in our attitudes towards one another and our economy, part of cyclical changes that have occurred in the past and strangely tend to repeat themselves throughout history over and over again. The Coming Cycle Although we can paint a short-term picture of rising markets, which will benefit investors, we would also like to counter that optimism with what we believe is knocking on the proverbial financial door and that is a more difficult cycle. In a whitepaper entitled, The Allegory of the Hawk and the Serpent, the hedge fund group, Artemis Capital Management, makes the case in a 100 year back test of the markets that there are periods of secular growth and periods of sec ular change. The secular growth stages they call The Serpent. They define these periods as times when secular growth is driven by positive demographics, economic expansion, technological innovation, globalization and economic prosperity. These periods eventually become corrupted by greed, as fiat devaluations and debt expansions replace fundamentals as the drivers of asset price gains that are not unlike a Serpent devouring its own tail. The Hawk signifies the forces of secular change and ultimately destroys the corrupted growth cycle of the Serpent. The left-wing of the Hawk represents the deflationary path, whereby an aging population leads to low inflation, faltering growth, a financial crash and then debt default. The right-wing of the Hawk represents inflation, fiat default, and helicopter money. According to the writer, neither path is mutually exclusive, and they often occur sequentially. The reason we are outlining these secular forces is that we believe the cycle is changing and we are transitioning from the Serpent to the Hawk. This transition will be more challenging and involves a different approach to money management than what has worked so effectively over the past 30-40 years. The Under-Performance of Traditional Portfolios I was recently on a client call with an investment manager in Pennsylvania. I raised the possible scenario of declining equity markets and rising bond yields (causing bond prices to decline). I asked what happens to your so called “safe assets” (i.e. bonds) if this scenario unfolds? Their response was “that they build portfolios for the long-term and that over the long-term a pure equity and bond portfolio complement each other and produce good risk adjusted returns.” Now I don’t disagree with this statement, but how do you define long-term? If it is longer than ones working lifetime (time to save) then it is really of no value to the average investor in my opinion. It seemed to me to be rather a close-minded response, especially when I asked if and how they might transition the portfolios for rising commodity, precious metals or volatility in the coming years should we transition to a more inflationary environment or even a stagflationary environment? As you can see from the Artemis Capital graphic below that during a transition from the Serpent to the Hawk, we tend to be at secular lows for volatility, correlations and yields. These above lows are what propelled traditional equity and fixed income portfolios to new highs but with these market constructs now moving off the lows and potentially higher, it is time to think differently. We cannot do this paper justice in the time and space we have in this blog update, but the bottom line of their research is that periods of deflation and then sequential inflation require the traditional portfolio of stocks and bonds be augmented with holdings in precious metals, commodity trend following and volatility trading strategies to perform well in the New Normal of the secular Hawk. The following chart from the Wall Street Journal demonstrates just that for the inflation side of the equation: Notice how the S&P 500 and Intermediate Bond returns suffer in such an environment. The whitepaper instead argues that non-correlated holdings in precious metals, commodity trend following and volatility trading work with the traditional equity and bond holdings to stabilize returns and reduce risk in the Hawk period, as seen below. They further make the point that a portfolio that is roughly equal in allocation between equities, bonds, precious metals, commodity trend following, and volatility trading has outperformed the more traditional 60% equity and 40% bond portfolio over the past 100 years, especially in the Hawk periods and likely will do so again in the coming Secular Hawk period. They call this portfolio a Dragon Portfolio (see below). We are not trying to scare you with this information, instead what we are suggesting is you need to make sure your investment advisor or manager is focused on this potential cycle change and has a plan for when and how to transition your more traditional stock and bond portfolios into other more favorable asset classes, like commodity trend following, precious metals and volatility trading, when the time is right. A pure stock and bond portfolio will likely struggle in this cycle’s periods of alternating deflation and then inflation as seen in the chart below, especially in the periods like 1964-1983 when stagflation was prevalent. On the other hand, our trend following models are already hard at work identifying turning points whereby equity portfolios need hedging or fixed income portfolio duration should be neutralized (i.e., hedged).

Those same models are also used in determining the best time to be in assets that benefit from deflation (where we are now) and inflation (where we expect we will be in the future). We have even rolled out a brand-new portfolio similar to the Dragon Portfolio outlined above to help clients best thrive during the coming cycle. So, when you sit down with your investment advisor or manager and you ask the question I asked above and they give you same kind of close-minded response, maybe it’s time to explore your options? As you can see in the above 100 year back test from Artemis, such a close-minded approach could be extremely costly to your portfolio(s) in the future. Let me know what you think in the comments section below.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |