|

Sometimes is seems the Federal Reserve and other Central Banks are running counterintelligence agencies and not reserve banks. A perfect example of this is Federal Reserve Chairperson Janet Yellen's comments on Friday that “in light of the continued solid performance of the labor market and our outlook for economic activity and inflation,” the case for raising interest rates again has gotten pretty strong of late.

The truth is that the economy is weak and there is no way they are raising interest rates. This was evidenced by the market's fast intraday reversal of more than 100 Dow points. It seems the Fed's best tool at present is to talk the market into believing they are leaning towards interest rate normalization (i.e. tightening) and then find reasons not to follow through. At least the other Central Bankers are not so nefarious with their actions. They are out there buying equities and pumping up markets with ever increasing monetary stimulus. So where will all this lead? I spent a good part of the weekend trying to figure out just that. The truth finally hit me when I watched a simple economic video that defined deflation, hyperinflation and stagflation.

According to Crash Course, hyperinflation is where inflation rises by 50% or more per month. So with hyperinflation the velocity of money increases as people spend money as quickly as possible to avoid a decline in the value of their money. This increased velocity of money changing hands increases inflation exponentially.

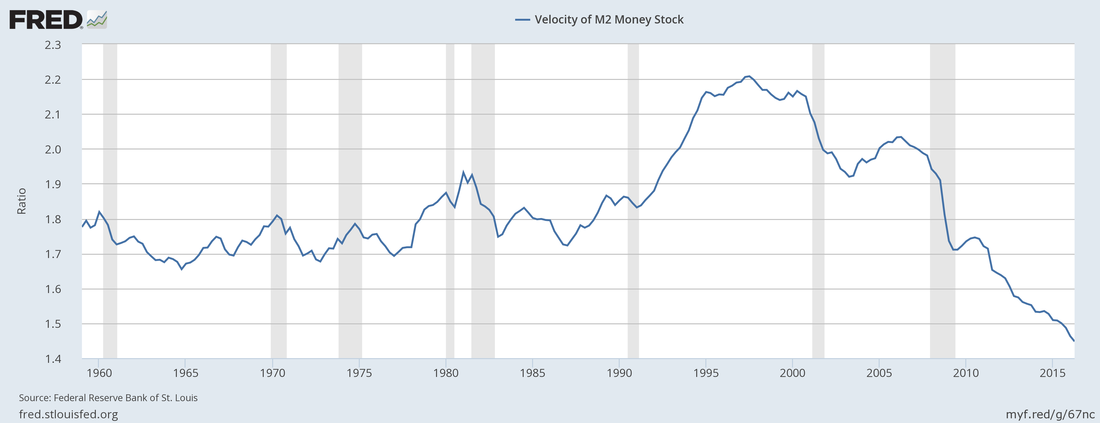

Deflation is a contraction in the supply of circulated money within an economy, and therefore the opposite of inflation results from declining or stagnate wages and falling prices. The velocity of money falls as people wait to buy what they perceive will be less expensive in the future. This decreased velocity of money changing hands increases deflation. Finally stagflation is when output stagnates at the same time that inflation rises. The end result of stagflation is price inflation, rising unemployment or stagnant wages and a disastrous economy. With stagflation the velocity of money may increase but output does not allow for significant increases as there is not the wage growth to support people spending money as quickly as it is earned. So the key to understanding where we are headed is to examine the velocity of money which luckily for us the St. Louis Fed provides to anyone who cares to look. Here is the current velocity of money:

M2 is a measure of the money supply that includes all elements of M1 as well as "near money." M1 includes cash and checking deposits, while near money refers to savings deposits, money market securities, mutual funds and other time deposits, according to Investopedia.com.

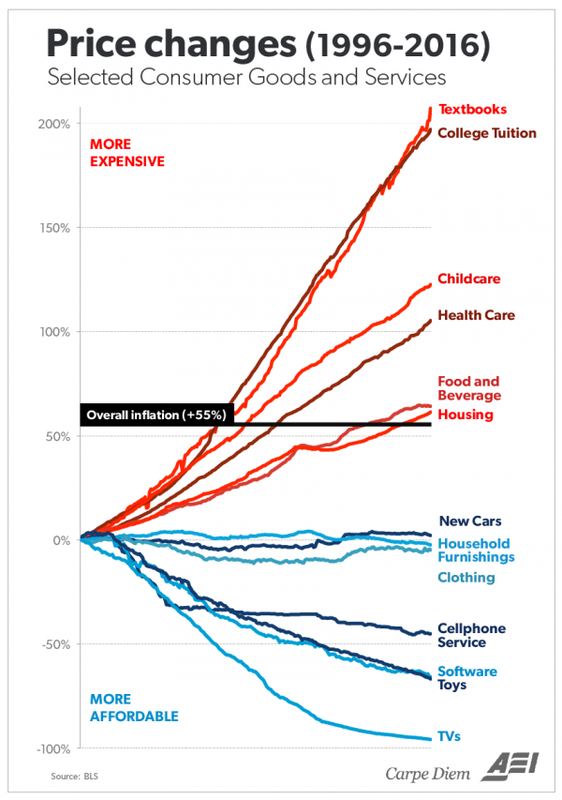

Notice how the velocity of money continues to fall off a cliff or move downward on the right edge of the chart. Assuming this data is accurate from the St. Louis Fed, this means that we continue to battle deflation. So as investors, what does this mean? First, you should delay buying things where prices have generally declined over time. The longer we wait, the lower the price (unless it is textbooks, college tuition, or healthcare).

Second, the government will not stop printing money until there is no more deflation and the velocity of money starts to rise.

This means that they will continue to try to find ways to make you feel wealthier, such as supporting equity markets. The Fed is not doing this directly, but Japan and Switzerland sure are buying U.S. equities and rumor has it that the U.S. has a facilities line with the Swiss that they are using to buying U.S. equities on behalf of the Fed because it cannot by mandate (at least openly). Mike Maloney of GoldSilver.com believes that first there will be deflation in the U.S. followed by all out monetary and fiscal assaults to overcome deflation and then that will be followed by hyperinflation. If he is right, we still appear to be in the deflationary stage and more stimulus is like to be the result. At the moment global growth is weak or in recession. The monetary policy is barely working because of wage stagnation, weak output and recessionary pains around the globe. All the more reason for those in power to double down! At some point, growth will increase and inflation will take off. So my final recommendation is use this time is to look for opportunities to buy at value today things that go up when inflation hits. These items include stocks, gold, real estate and other hard assets. I cannot tell you the timing of when things shift, but I believe it will happen. For all I know it may be happening now as gold has broken to new highs. I personally am looking to use the pullback currently underway to add to my position as a hedge against inflation and further debasement of global currencies.

3 Comments

8/29/2016 12:41:46 pm

I want to add to this post that paying down debt is also a good thing in a deflationary environment. In a deflationary economy, dollars are worth more going forward. That's because falling prices allow each dollar to buy more in the future. People worried about deflation want to avoid debt because deflation would make paying off a loan even more expensive.

Reply

8/30/2016 09:36:56 am

Thanks so much for this very informative article put in terms we all can understand. I've heard it said that if you can't explain something simply then you don't know it well enough. This shows clearly that you are an expert!

Reply

Your comment will be posted after it is approved.

Leave a Reply. |