|

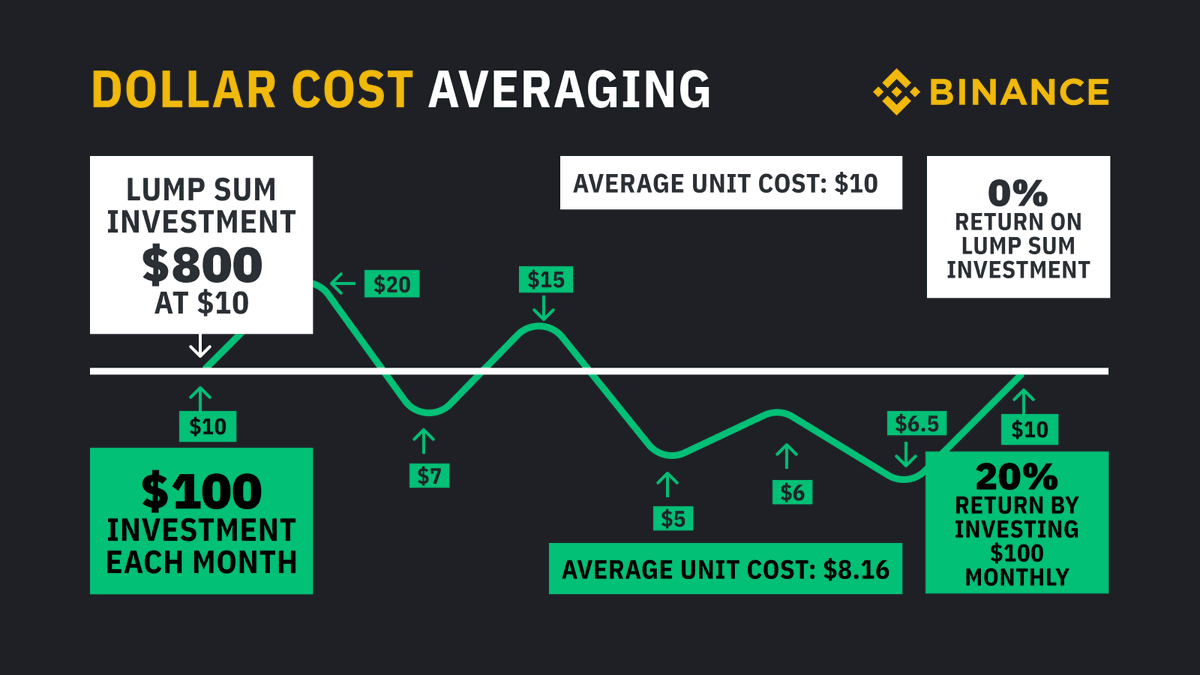

Do you have capital to put to work? There is no better way in an uncertain market than to use dollar cost averaging. What is dollar cost averaging you may ask? According to Investopedia, Dollar-cost averaging (DCA) is an investment strategy in which an investor divides up the total amount to be invested across periodic purchases of a target asset in an effort to reduce the impact of volatility on the overall purchase. The purchases occur regardless of the asset's price and at regular intervals. Here is a graphic example, courtesy of Binance: With dollar cost averaging in green, regular investments are made without regard to price at the time. Generally, as the example above shows, some purchases are at higher prices and some a lower prices in a volatile market.

The idea is to take the risk out of investing a single lump sum and being wrong on the timing, but instead letting time and the ability to purchase at differing price/cost levels be your diversifier. With single lump sums, if your timing is off, you can cost yourself money in a tough market, like the one we are in now as price moves below your entry price/cost. Dollar cost averaging helps you avoid this risk. Alternatively, in a fast-rising market, dollar cost averaging can cost you money as you buy at progressively higher levels vs. an early single lump sum. Although this is certainly a risk, the problem is that very few people have a crystal ball and get their market predictions correct even some of the time. As many of you may know, we are more active in how we manage portfolios and feel we have some insight into markets via our work. However, we rarely will be put a lump sum to work without averaging into positions over time because market forecasting is just so tough, especially in the short term. As an example, I have been expecting another bear market bounce as I am writing this post based both on market technicals and an overly negative investor sentiment, however, here we are a few trading days later with some indexes below their March low and others hanging on by a thread. Who could possibly forecast where markets go from here in the short-term, especially with Federal Reserve Meetings on the horizon? When is the best time to use Dollar Cost Averaging? The easy answer is any market, but we find it most helpful in volatile sideways or declining markets. Here is why. First, you are buying shares at lower and lower costs vs. a higher cost had you done a single lump sum. You are essentially averaging down, and history tells us there is a market bottom eventually. Second, a stock market downturn produces a kind of “clearance sale” environment. Envision the markets as a department store, with signs everywhere announcing 20% to 40% off. You have a chance to buy into some top-quality companies “on sale.” As a consequence of dollar cost averaging, you can now buy in at a lower price, obtaining more shares for your money. Finally, when the markets eventually turn up, these extra low-cost shares really supercharge the recovery of your overall portfolio vs. waiting to buy when it is clear that coast is clear. Dollar cost averaging is just one of the tools we use for clients in tough markets, like this one. We also employ hedging and tactical trading in some portfolios and the oldest strategy of them all in many portfolios, raising cash. If your advisor is not adding as much value as he seemed to be just last year, why don’t you reach out to us for a free portfolio review? I can tell you that our clients are not ringing the phone off our hook in this volatile Bear Market!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |