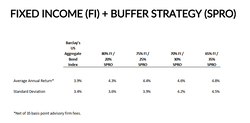

I get asked frequently "how can I find a better yield on my cash deposits?" The answer - "that one is a hard one! How much risk are you willing to take to get higher yields?" Their response is usually "no more than I am taking now at my local bank." The problem is that the Federal Reserve (the "Fed") has those seeking yield in between the proverbial rock and a hard place. The Fed policies of buying outstanding debt (i.e., quantitative easing) to keep rates on treasuries low and, thereby stimulate economic growth, have really hurt savers. They have also forced investors to take greater risk to earn higher investment returns so they at least keep up with inflation. This in turn has created bubbles in many asset classes that have significantly stretched historical valuations and investment risk metrics. So what is a yield starved investor to do? Today we will explore a handful of options. However, I don't think any of these options is a singular answer. Instead a diversified approach may be your best option in this challenging environment! 1. Crypto Stable Coins I mentioned crypto stable coins like Tether, USDC and UST in a recent post called Miscellany. For instance, I converted U.S. dollars into USDC stable coin and then put it on deposit at several crypto banks and now earn north of 8% on those funds. The downside? Crypto is lightly regulated and the SEC is now stepping up it's reviews of stable coin providers and their underlying reserves. In my personal case, I didn't put more than I could afford to lose in stable coin and I split it up amongst several U.S. based crypto banks. You can find out more about this option in an article entitled What are Stablecoins and Why Invest in Them? 2. High Dividend Stocks There are high dividend stocks and stock funds such as Amplify's High Income ETF(symbol YYY) which currently yields 9.04%, according to ETF database. The problem with high dividend stocks are 1) they have high dividends usually due to a price decline or a high degree of investment risk and 2) if markets go down, the yield will rise but any gains here will be offset by unrealized losses in the underlying stock or ETF. Take a look here at YYY (red line) vs. the S&P 500 ETF (SPY) (blue line). Wouldn't you rather have had the return of the S&P 500 when it appears you are taking a lot of risk in the Amplify High Income ETF based purely on comparing the periods of market decline for both securities? A solution here might be to actively trade or apply a trading methodology to ETF, but even so you could do that to the S&P 500 as well and earn a higher overall return. 3. Total Return Strategies With total return strategies, you are not looking for yield, but a greater overall portfolio return. Instead of distributing income to support your lifestyle, you periodically raise some cash and make distributions from principal. We recently released a total return strategy for enhancing cash returns. It allocates between 65-80% of the portfolio assets to fixed income ETFs that are chosen based on their yield adjusted duration. The idea here is to get as much yield per unit of duration (e.g. a measure of a bond's or fixed income portfolio's price sensitivity to interest rate changes) as possible. It pairs that with a diversified portfolio of buffered ETFs where each position has both a known floor (loss) and capped upside. Essentially giving up some potential upside for a lower downside. The result:  Disclosure, these results above are ALL back tested using the CBOE S&P 500 Buffer Protect Index Balanced Series plus the Barclay's Aggregate Bond Index. This former index may not exactly match the diversified index of buffered ETFs. Past performance is not indicative of future performance. Now that we have that out of the way, you can see that based on this historical data since 2006, we where able to enhance overall total returns with less risk (i.e., standard deviation) at least in back-testing. 4. High Yield Teaser Rates The final area where you can get enhanced yields in from internet firms offering teaser rates for new customers. Bankrate.com has a whole list of such firms, mainly internet banks offering yields of around 50 basis points at present. The difficulty we have found with such rates are they are only available to individuals, not businesses and each has minimum deposit amounts and restrictions. 5. A Diversified Bond Portfolio One final option might be just a plain old fixed income portfolio. With the right allocation, you can get yields north of 2.5%+ and durations as low as 3.08. We do this for clients and also change positioning from time to time to minimize downside when rates escalate as they have been recently or capture more gain when rates decline. Final thoughts One of the frustrations for yield oriented investors is there is no one place you can put your hard earned capital and earn high yields and have FDIC protection. However, I think it is also clear that there are a number of options that when mixed and matched could provide you with the overall yield you desire and enough diversity to potentially minimize losses if equity or bond markets decide to sell off. Let us know if we can help.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |