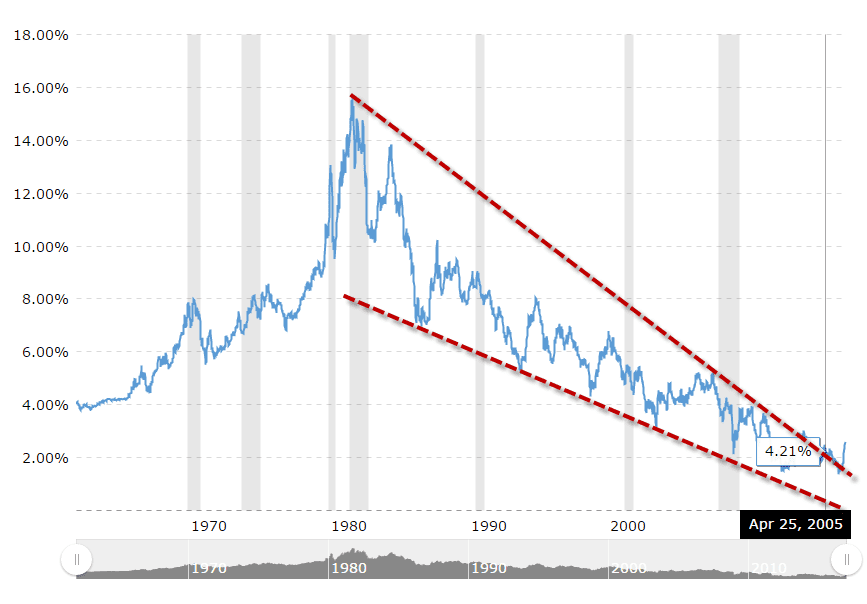

#1 Take Losses in 2016 and Defer Gains till 2017This one is our number one idea just because it is time sensitive. You need to take those losses now in the last few days of 2016 to realize the ability to offset any gains that may be taxed at higher rates for the year. In 2017, our hope is that President Elect Trump will get his tax rate reductions through Congress and deferred gains taken in the new year will be potentially taxed at lower rates, thereby making 2017 a better year to take any gains, especially short-term, from the sale of assets. At least that is the plan! #2 Consider a Roth IRA Conversion in 2017Likewise our next planning idea for 2017 is tax driven. If President Elect Trump can lower rates, the investor in me says what are the odds that such rates can go lower? With rising national debt levels at just about $20 trillion and the Tax Policy Center predicting Mr. Trump's proposed policies will raise the national debt by another $7.2 trillion, what are the odds that somewhere along the line the next administration will have to raise taxes to cover the debt service on the rising national debt? My guess is pretty good! We know for certain it will be hard for Washington to stop spending our hard earned tax dollars. So barring the "unbelievable" growth that Mr. Trump promises, at some point taxes will have to go back up. That could make this point in history, post Trump's tax reforms, the likely low point for tax rates. With that the case, it may be the best tiime to convert taxable IRAs to Roth IRAs that defer tax free if held for 5 years and to age 59 1/2 or more. The key here is Mr. Trump's tax reform proposals must be come law first before you go this route. #3 The 30 Year Interest Rate Cycle Has TurnedIf you have a bond portfolio, you may have already noticed that something is up in bond land. The thing that is up is rates. As you can see in the chart below, the 30+ year bull market in 10 year bond yields is up. Remember lower bond yields equal higher bond prices and vice versa. Notice how recent rate increases have broken the dotted red downtrend lines to the upside? The trend is now up for bond yields! Don't panic however, this trend is just beginning and, just like the road down for rates, the path up will be filled with ups and downs. In fact, I believe rates could retrace some of the recent rise before they make another move higher in 2017. However, the buy and hold game with bonds is probably over unless you are holding to absolute maturity! It is important that you find an advisor that understands how to manage bonds or bond alternatives in a rising rate environment. May we suggest that if your advisor seems clueless, it's time to change advisors. FYI - this likely also applies to high income securities like utilities, REITs and other income generators that will be in someway affected by rising rates. #4 Active Managers Will OutperformOk, I know this seems a bit self serving, but it is not. So many folks have shifted to the passive side of the boat that we believe it is likely time for active investments to shine (see Is the Market for Passive Strategies Really Just Load Shifting?"). They certainly have been out of favor the longest period of time I have ever seen! The rational here is that the Federal Reserve is attempting to raise rates in a period of tepped growth so they have ammunition to fight the next economic downtown. In our opinion, they are a day late and a dollar short! In other words, their actions will bring about the next possible recession here in the U.S. When recession comes, markets will fall and this is typically when active managers outperform. When the recession ends, we believe Central Banks will have once again eased into the recession and will have very little impact on the following up cycle. This will likewise be good for active managers as Central Bank intervention has been the bane of such strategies since in 2009 lows. Our suggestion is that you diversify with both passive (buy and hold) and active strategies in your porfolios. We don't know the exact timing obvously, but 2017-2018 will likely see a move back toward active manager outperformance and you will be prepared for such a move. Remember that both active and passive managers have been around for hundreds of years and it is not uncommon for one or the other to have periods of outperformance and then periods of underperformance! #5 Maximize Income in or Through a BusinessHere is another idea that is totally Trump dependent. Make sure you are capturing as much of your income via corporate entities as possible. President Elect Trump has proposed lowering the corporate tax rates for all types of entities including S-Corporations, partnerships and C-Corporations to 15% tax rates. For many this would mean their corporate tax rate could be lower than than there personal tax rate. So now may be the time to rearrange your affairs to take advantage of this possible windfall for corporate entities and their partners, members or shareholders. Just like #2 above, our best advice is to wait until it's clear Congress is going to pass this proposed tax measure. However, if they do, there could be a clear path to lower tax rates. Well that is our Top Five Key Investment and Planning Ideas or themes for the upcoming year. Let us know your thoughts below in the comment section or if we missed another possible investment or planning idea, please feel free to share it!

Have a Prosperous New Year!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |