|

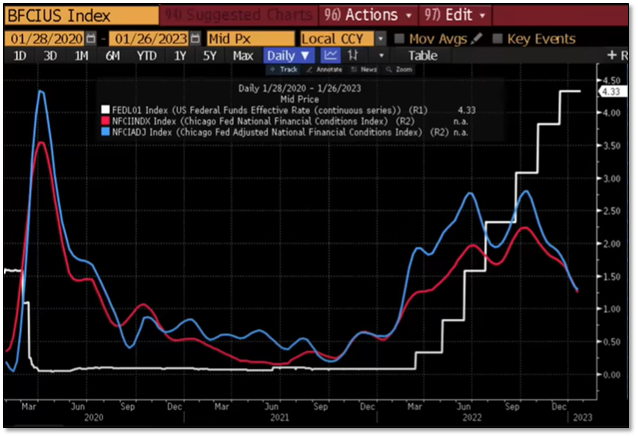

Over the past month, stock markets around the world have been rallying on two things. The first is the assumption that the U.S. Federal Reserve will stop and/or even reverse their interest rate policy that has take rates from near zero towards 5%. The second is the reopening of China post Covid in that country. The million-dollar question is the market right (new Green Shoots) or will this end badly for market participants (a Mirage)? You may recall the market has had Bear Market rallies leading up to the last several Federal Reserve Open Market Committee meetings just be to smacked down by the Fed and markets thereafter. No manager really knows for sure. We suspect that the Federal Reserve will have some rather hawkish commentary for the markets, but we could be wrong. Only the Fed knows for sure at this point. What is interesting to see is how the markets push the envelop trying to anticipate the next moves for interest rates and the economy. They are essentially front running the Fed as you can see in the chart below: Markets have rallied all the way up and slightly beyond the long-term trend line (blue line) for this Bear Market to date. It is amazing the timing that this all happens right into the week of the Fed’s Open Market Committee meetings which are Tuesday and Wednesday of this week. Traditionally, I think the market knows ahead of the Fed and it would be smart to follow the markets. However, this time around, the markets by rising have essentially eased liquidity, this drives the wealth effect, which then drives spending and finally that drives inflation. You can see how financial conditions have eased below with both the Chicago Fed National Financial Conditions Index and Chicago Fed Adjusted National Financial Conditions Indexes in red and blue declining relative to the white Fed Funds rate. If you are the Fed, that is the last thing you want when you are trying to fight inflation! Also, the reopening of China following Covid will put additional upward pressure on commodity prices, which is inflationary. Again, this is exactly what the Fed does not want.

How will the Fed respond? We believe they will be extremely Hawkish and tell the markets that they have much further to go with either Fed Fund rate increases and/or that there will be a lengthy pause when they do stop raising Fed Fund rates to see how past Fed Fund rate increases will affect the economy and inflation. They will definitely dispel the notion that they will be reversing Fed Fund rates as the market is now forecasting. This will not be music to the market’s ears! The result will be a long-overdue pullback or even the resumption of the Bear Market decline. As we have told clients in one-on-one annual reviews, we expect a lot of fits and stops for the markets in 2023. Inflation followed by disinflation and then deflation and then back to inflation. It is going to be a fluid market environment! Again, we could be wrong and if that is case, we will course correct! Maybe we get a pullback that leads to a breakout and higher markets. That would be fine with us as long as we get that pullback! So much of this market is about waiting, watching, and then reacting at the right time. It takes patience, nerves of steel and it will very tough to get completely right! We will see if that patience pays off this time! At InTrust Advisors, we pair actively managed and passively managed investments in client portfolios to lower volatility and hopefully enhance long-term returns. If this is something you are looking for, please feel free to reach out to us for a free consultation. Disclosures Past performance is not an indication of future performance and there can be no assurance that the strategy will achieve results in line with those presented in this performance summary. This document is for informational purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The S&P 500 is a capitalization weighted index of the 500 leading companies from leading industries of the U.S. economy. It represents a broad cross-section of the U.S. equity market, including stocks traded on the NYSE, Amex, and Nasdaq. The Chicago Fed’s National Financial Conditions Index (NFCI) provides a comprehensive weekly update on U.S. financial conditions in money markets, debt and equity markets, and the traditional and “shadow” banking systems. Because U.S. economic and financial conditions tend to be highly correlated, they also present an alternative index, the adjusted NFCI (ANFCI).

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |