|

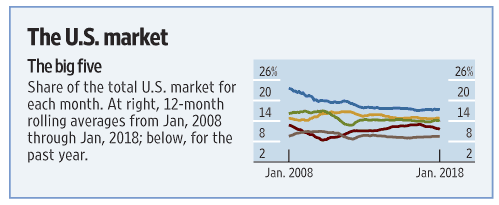

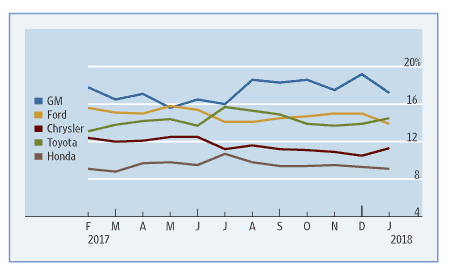

In the 1970s and 1980s, Japanese car makers made hugh strides improving upon both their manufacturing capabilities and in the quality of the vehicles they introduced. It was not so much that they were innovators, but they found new and interesting ways to improve upon what was already out there and offered by other automakers. “Kaizen” is the Japanese word for “improvement.” During this period and even today, it has become synonymous with the philosophy made famous by Japanese manufacturers, most notabily Toyota. According to Investopedia, “Kaisen” involves improving processes. Instead of focusing on the product, the idea was to improve the way it’s made, and those are two different things. Formally, it's using statistical methods to examine the variations in outcomes, and work out ways to get closer to the result you want. So, for example, instead of just saying that a factory has to produce pipes with tolerances of 1/1000th of an inch, managers would look at the variation between parts and try to see if that could be narrowed. This focus on “Kaizen” allowed Japanese automakers to increase their share of the U.S. auto market while the U.S. Big Three automakers’ shares declined. It is also why it’s tough to find a bad vehicle today as global automakers had to improve to keep up with their Japanese counterparts. Courtesy of the Wall Street Journal Just like the Japanese, we are also always looking to improve or “Kaisen”! In the last ten years, InTrust moved from mutual funds to individual stocks and exchange traded funds (ETFs) as the primary vehicles for implementing client investment ideas. We moved from mutual funds to ETFs because they are:

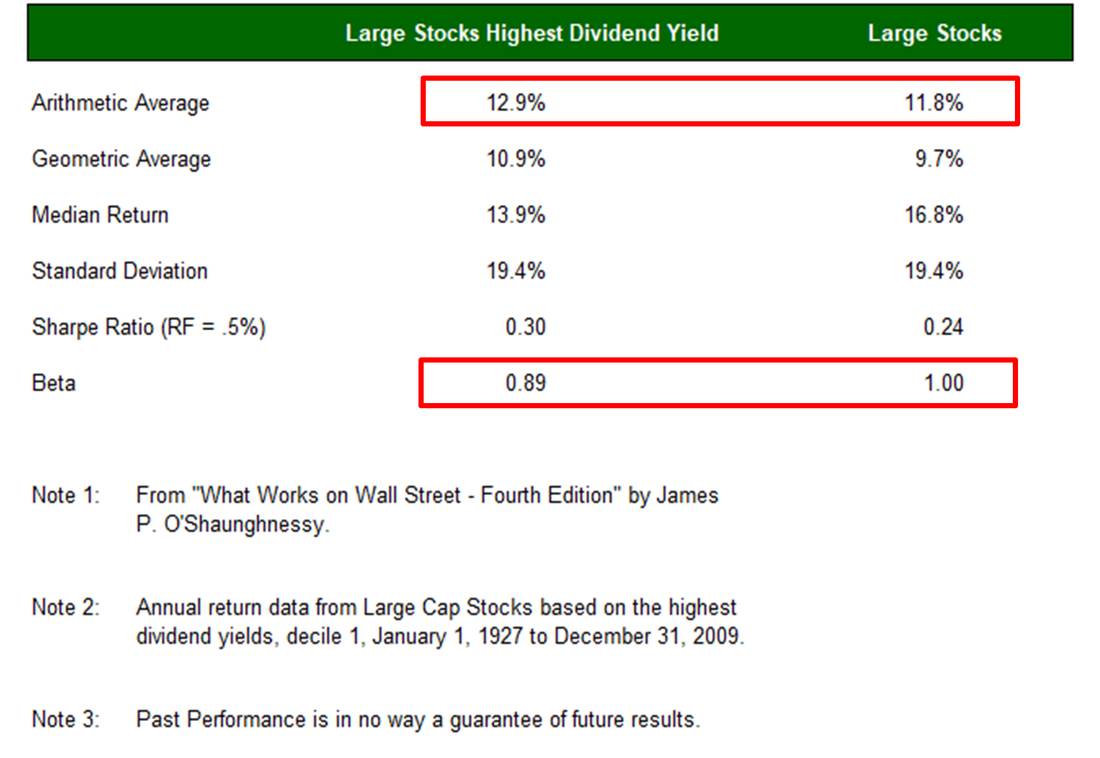

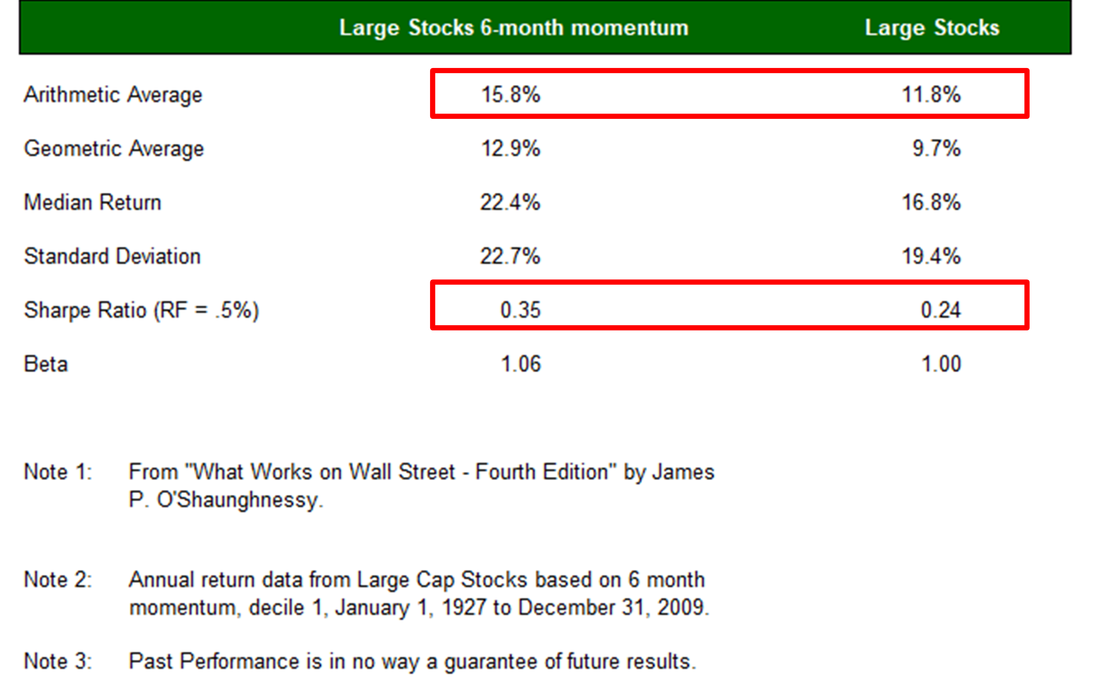

ETFs, like everything, have continued to evolve from a basic group covering a select group of indexes to over 5,024 funds trading globally, according to research firm ETFGI. When we started out with ETFs, the small number of them made choosing the right one simple. Now with more than 5,000 ETFs to select from the choices are great and varied, including passive, actively managed, sector, environmental, social and governance (ESG), inverse, leveraged and factor or smart beta ETFs, just to name a few. We likewise have continued to evolve. I told clients in our last quarterly newsletter that we had added factor-based ETFs to our approved list of funds. The reasons are simple for this addition: historically they have outperformed their benchmark indexes while still offering the all the advantages above that drew us to ETFs. His in landmark book called “What Works on Wall Street (4th edition),” James O’Shaughnessy showed that introducing certain factors such as low price to earnings, high dividend or high momentum to a portfolio of stocks greatly improved long-term portfolio performance. In this case, long-term was looking back 40 to 100 years of data. What he found in this research was that large cap stock performance was greatly improved by adding high dividend stocks to a portfolio , as you can see below. At the same time, the beta or volatility of return relative to the benchmark declined. This is why we have added such ETF positions to many of our Personalized Portfolio Solution (a modified buy and hold strategy) portfolio where doing so was not income tax prohibitive. It is also why our Equity Value and Balanced portfolios solutions work so well as they include the highest dividend paying stocks in the Dow Jones Industrial Average in their portfolios. O’Shaugnessy also found that large cap stock performance was greatly improved by adding momentum based strategies to a portfolio. Momentum is where a stock or security is experiencing greater price movement than their peers over a given period of time for a given type of stock, such as large cap stocks. Adding momentum stocks increased returns historically vs the benchmark but also increased the beta or volatility of return. However, this increase in beta was more than offset by the resulting uptick in performance as reflected in the Sharpe Ratio.

This is why we have added such ETF positions to many of our Personalized Portfolio Solution (a modified buy and hold strategy) portfolio where doing so was not income tax prohibitive. It is also why our Equity Growth portfolio work so well as it incorporates the highest momentum stocks in the Dow Jones Industrial Average into its portfolios. It should also be noted that momentum and deep value (high dividend payers) are the perfect complement to trend following based timing models, which allows us to focus on not just growing your capital but protecting it! So I have a simple question for you? Is your advisor constantly looking to improve or “Kaisen”? If the answer is no, maybe it’s time to get a free second opinion?

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |