|

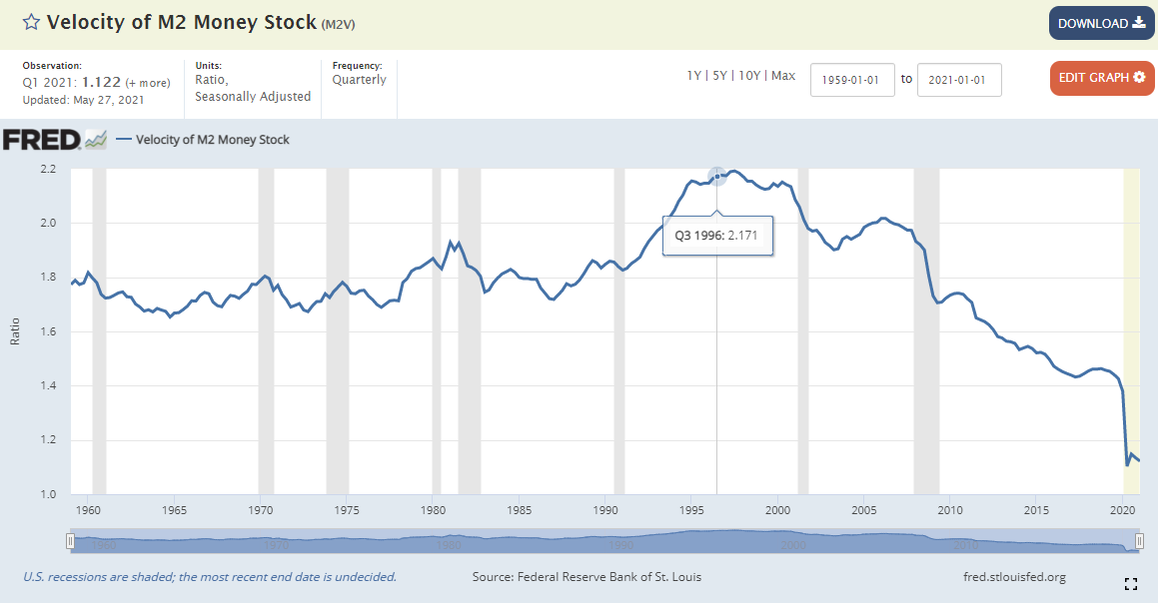

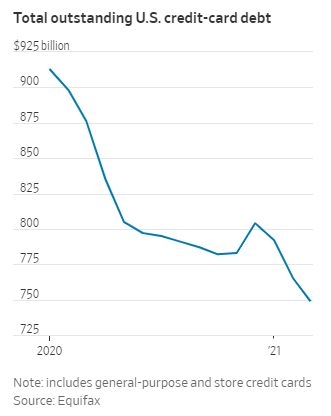

The Federal Reserve (“the Fed”) in each of its recent meeting releases has called the inflation we are now experiencing “transitory.” The result of the reopening of America post Covid-19 and supply chain disruptions with everyone attempting to purchase product all at once in a “just in time” inventory system that adjusted to the lack of demand in 2020 and now is having trouble getting back up to full capacity on the re-open. Our take is that the Fed is actually correct this time (as much as we hate to admit it). If there was lasting inflation in the economy, we would see it in the velocity of M-2 money, where money is changing hands from one person to another. As you can see in the St. Louis Fed chart below, the velocity of money is still trending lower. If inflation was truly present, we would see rising use of credit. However, the Wall Street Journal reported on May 11th that “Americans are paying down their credit-card debt at levels not seen in years.”

Finally, is investment manager Kathy Woods of ARK investment Management. She says U.S. Set Up for 'Massive' Deflation! Our Take We believe the current inflationary trend is transitory. Much of it is supply chain related and purchasing managers have been ordering double or triple their normal order sizes to get product. Much of these orders will be cancelled when some product comes through the supply chain. We can already see Wall Street starting to move towards a slower growth and disinflationary stance in the charts as many commodity charts are now looking like they will correct (pull back) and technology and growth stocks appear to be bottoming. For instance, this chart of the commodity CRB index shows that such prices are now at the historical downtrend line. The price momentum has waned and it starting to roll over.

In our portfolios, we have started to move away from pure commodity plays and back to deflationary assets, like precious metals as it is clear to us that the commodity complex will at least pull back here in a deflationary retreat. We believe that growth will come in slower than anticipated over the next few quarters on a comparative quarter over quarter basis. There will be more saber rattling about large tax increases by Washington and this will create a deflationary push back to growth stocks and away from value and commodities. Interest rates (i.e., yields) will again move sideways to down as it becomes clear that the inflation we have experienced, for the most part, was transitory. We believe you could see sideways to down markets in those names now doing well. We are not sure how far this weakness could extend, but it’s possible the whole market takes a breather. Weakening growth will spur further intervention by Washington and increased asset purchases by the Fed. This will help keep market stabilized and moving upward, but at what long-term impact? The next step we believe is that Americans and developed market consumers go back to life as normal. However, lurking out there some time down the road is the fact that consumers do become more confident and start spending. Maybe it because they finally start to make higher wages, which is inflationary. This spending begets spending and the velocity of money starts to turn upward. It is here where the Fed and other Central Banks now need to be careful as we could see not just inflation at that time, but hyperinflation because of a stimulus and easy money now prevalent in the markets. We obviously don’t know the timing of that latter phase, or if it will even happen. However, we do know that the market will continue to have periods of inflation and then deflation as it did in prior cycles. The easy money of the past 30-40 years is done, over. The same old 60% stock and 40% bond portfolio is going to struggle at times in this new cycle. So, let me leave you with a question? Is your advisor going to be able to navigate what I just laid out without losing you money? If the answer is “no,” how about scheduling a time to talk about your investment assets?

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |