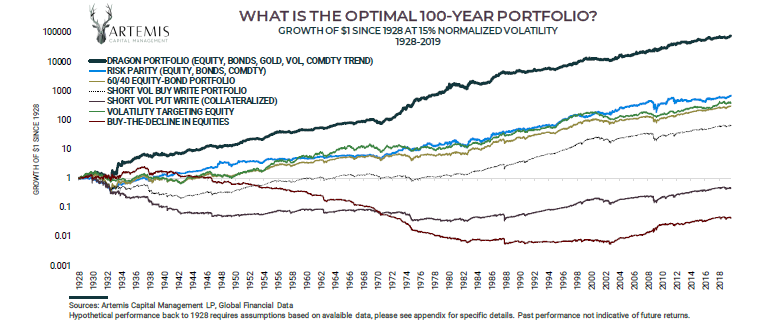

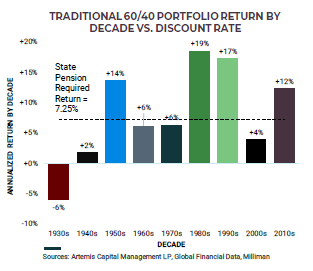

When I first entered the business way back in 1995, it was quite common to look at portfolios and see a diverse set of assets including precious metals, commodities, hedge funds and CTAs, as well as, equities and fixed income or bonds. Over the past ten to fifteen years however, the amount of market intervention by Central Banks and from global governments has made such diversification almost mute. Today, it’s much more common to see just portfolios of stocks and bonds. Investments in precious metals, commodities, hedge funds and CTAs (for the most part) have been underperformers. A loser’s game! I mean had we all known then what we know today, we would have all just bought the S&P 500 index right? We would have learned to deal with the market volatility knowing that each market decline would spawn a reaction by global central banks and governments to prop back up the ailing markets. However, as we all know hindsight is 20/20! I still marvel at why such parties cannot let the markets do what they do best, i.e. run in cycles of boom and bust. The busts bring sanity to the markets and help to eliminate the bad players. They have to realize that when this managed market does end, it is going to end very badly for many participants, or maybe that is the plan? Who knows? My point is that a portfolio today that includes 60% equities and 40% bonds is not really diversified when stocks are at nosebleed valuations and bonds are at historical thirty-year lows in yields and near zero yields. The protection that bonds now afford investors to hedge equity volatility is muted at best if not non-existent. I can actually envision a scenario where both stocks decline, and bond yields rise, and investors lose money on both sides of the portfolio at once. So, what is an investor to do? Since markets are mean reverting, I believe we need to start to look to the past to move forward into the future. This means a slow reversion back to portfolios that are more diversified and contain assets classes that have historically provided some shelter in the storm, whether that is equity market volatility, rising deflation or inflation, currency devaluations and more. In a study that Artemis Capital Management performed in January 2020, they found that over the past 100 years it was common to have periods like we have had whereby growth reigns fueled by the virtuous cycle of value creation and rising asset prices. The growth cycle began naturally through a combination of favorable demographics, technology, globalization and economic prosperity. However, such growth eventually became corrupted by greed. Fiat currency devaluations and debt expansion replace fundamentals. Isn’t that exactly where we are today? Those growth periods were followed by periods where the corrupted growth cycle was destroyed. This destruction led to a periods of either deflation or inflation, many times alternating from one to the other. The deflationary path was caused by an aging population which leads to low inflation, faltering growth, financial crashes and then debt defaults. The inflation cycles were led by fiat currency defaults, and helicopter money. Maybe you recognize the helicopter money as the latest $600 stimulus checks just approved by the Congress? During these latter periods of corrupted growth and intermittent periods of deflation and inflation, they found that traditional portfolios of 60% equities and 40% bonds underperformed. What they found is that more diversified portfolios that included commodity trend followers, precious metals and volatility traders significantly outperformed the latter 60%/40% portfolios during these periods. We believe we are in the latter stages of that corrupted growth cycle.

The transition has to start now to more diversified portfolios that include more than just equities and bonds. To more of the diversified portfolio like you see above that Artemis has called the Dragon Portfolio. We will write on this later, but we also believe that means a renewed importance of having both passive index strategies and active investment strategies in your portfolio, a multi-disciplined portfolio as we call it. Just like the latest fashions, what is old is new and what is new is old. Funny how that works! So, the question becomes “what’s in your portfolio?” If this is not a discussion you are having with your advisor, it may be time to find a new advisor? Let us know if we can help.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |