|

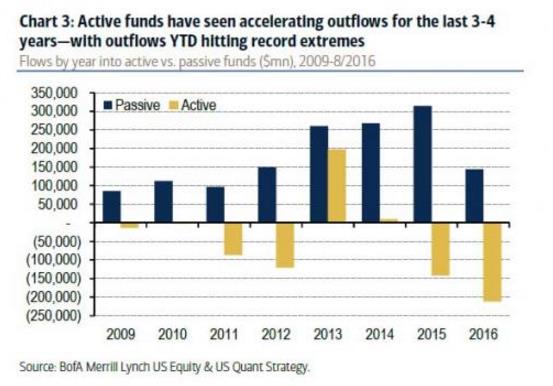

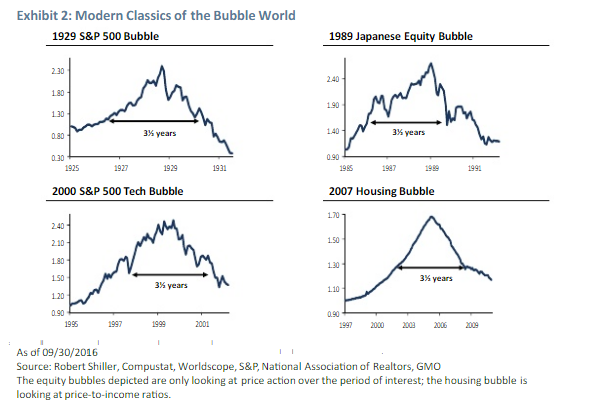

It seems a day doesn’t pass where I don’t see an article about some family or firm dumping their active manager or hedge funds for passive, buy and hold investments. In fact through July 2016, hedge funds had seen seven years of under performance and a record $200 billion+ in outflows so far in 2016. According to Bank of America’s Savita Subramanian, “over the last several years, we have observed an accelerating trend of flows out of active funds into passive vehicles. Price sensitivity of investors to fees, coupled with poor performance trends, have conspired against active funds, and year-to-date flows out of active have reached a post-crisis high.” Now as many of you know, we are mostly an active shop. We have strategies that are passive in nature, but even those strategies have active overlays. There is also no doubt that the last seven+ years have been a challenge for us and others as repeated interventions in the markets by Central Bankers have dampened volatility and wreaked havoc with active manager models and technical signals. However, what I see now from investors is more of a full scale stampede into passive strategies. They believe they are doing the right thing to reduce management fees and while maximizing returns in this managed market. However, I believe this to be the equivalent of an entire ship load full of passengers shifting to the same side of the boat and not expecting the boat to capsize into the cold blue ocean. This “load shifting” as it is called in the transportation industry has actually increased risk and put them all on the same side of a dangerous trade. This type of investor behavior has a name. It is called “Recency Bias. According to DaveManual.com, Recency Bias is the phenomenon of a person most easily remembering something that has happened recently, compared to remembering something that may have occurred a while back. In our case, investors have forgotten the Bear Markets of 2000 – 2003 and 2007 – 2008 and instead focused on the pain of under performance in recent years and are therefore setting themselves up for disappointment. The average bull market length since 1937 has been 39 months or less than four years. This current bull is now the third longest in history at 91 months. What are the odds this one continues significantly longer? I would say slim to none given the slowdown in growth we are already seeing globally. Most astute investors would agree that we are in one of the greatest market bubbles of all time. The last time we had such a bubble in 2007-2008, stock markets dropped by some 39% as measured by the S&P 500 index. It is therefore likely, that this next Bear Market could be at least as big. Wouldn’t you agree? Finally, most active managers do substantially better than passive managers in a bear market. We are trend followers here by nature and that is the only strategy that tends to not-correlate with traditional market strategies. In English this means a pure trend following strategy should make money when others lose money in a bear market. I use the word “pure” because very few of our strategies are “pure” trend following and therefore our expectation is just to sidestep losses not necessary to make money in a bear market. However, in either case, the bear market is the equalizer. In a bear market, passive strategies will get hammered and active strategies should do relatively better. This relative out performance should equalize the active vs. passive long-term performance. So now turning back to seismic shift to passive strategies, my belief is these investors are throwing in the towel at the wrong time. They will likely look back and realize later they under performed for years in active strategies and then shifted to passive strategies just in time to lose 30-50% of their money in the next bear market. What a nightmare! A Final Note on the Next Bear MarketIn September, I posted that GMO had forecast 7 year asset class real returns and many of those asset class returns were negative. I likewise showed how active strategies could enhance returns during such a period in my post entitled “Return Forecasts Don't Always Tell The Whole Story.” Now GMO is out with another commentary on the next bear market. According to its letter to investors, GMO built the case that when the market bubble pops, it could be more of a slow whimper than a loud pop. In a rather long 37 point thesis, GMO lays out the reasons for the former conclusion including the fact that most classic bubbles have taken at least 3 ½ years or more to decline and were actually quite orderly as you can see below. For us this was quite exciting because our models are much more effective in a slow moving decline, like in Japan above, than a bubble that pops and results in massive, very short term declines.

So bring on the bear!

1 Comment

11/27/2016 09:44:38 am

Here is a pretty good follow up analysis to our post above from RMG Investment Management. Check it out!

Reply

Your comment will be posted after it is approved.

Leave a Reply. |