|

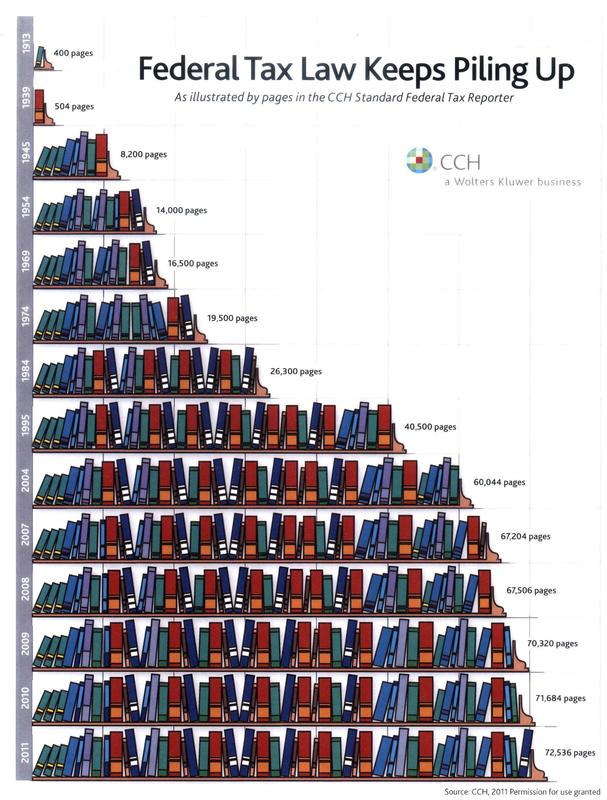

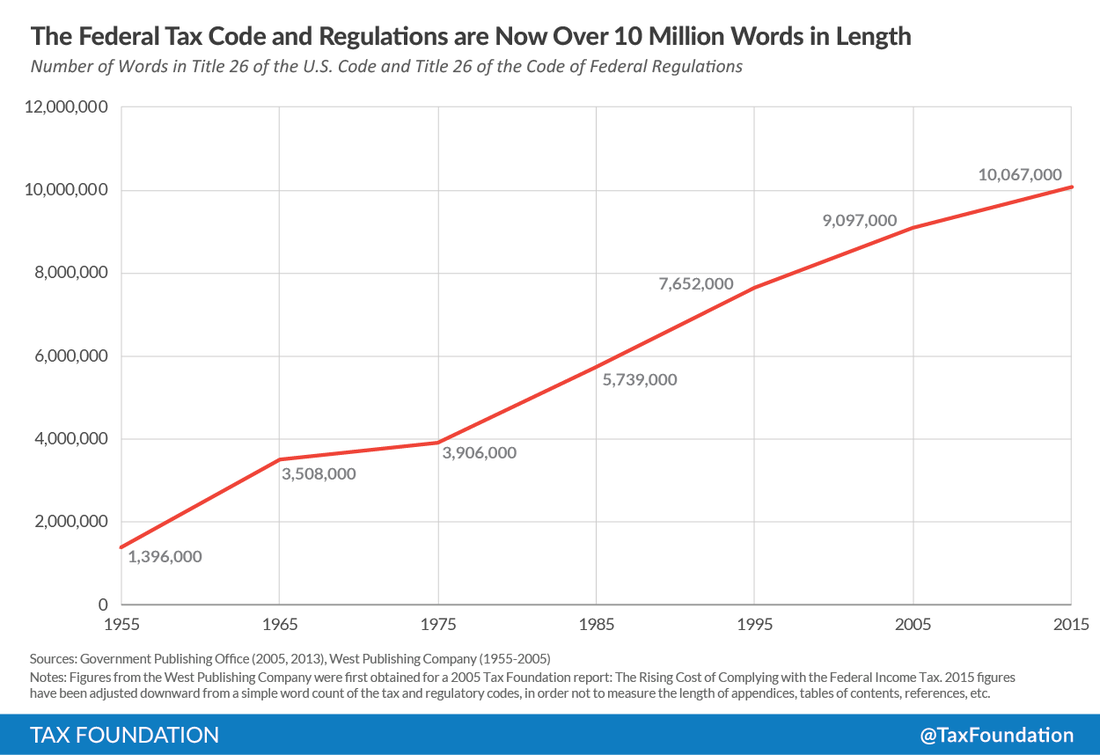

On October 3rd, 1913, President Woodrow Wilson signed into law the Underwood-Simmons Act, creating what would be the first modern U.S. income tax. The tax legislation was only 16 pages and imposed a base tax rate of just 1%. The actual tax code and regulations were just 400 pages in total. The highest tax rate was set at just 7% for individuals earning more than $500,000 or about $12.6 million in today’s dollars. At that time, the tax was not meant to be permanent but was to pay for the costs of World War I. In fact, the tax rates were cut some four times during the 1920s. Today, tax code and regulations are more than 70,000 pages in length! It has so many rules and code sections you would need a tax program just to remember them all. In fact, most CPAs today rely a great deal on such software to navigate the ever-increasing code. It was rather ironic recently when House and Senate Republicans decided that tax cuts and simplification would be a good thing! The results of their laborious process have been bills from both houses to slash tax rates for both individuals and corporations. These bills are now in reconciliation, a legislative process of the United States Congress that allows expedited passage of certain budgetary legislation on spending, revenues, and the federal debt limit with a simple majority vote in both the House (218 votes) and Senate (51 votes). The two bills will be combined into a single workable bill that can go to the President for his signature. The Senate bill alone is 479 pages in length. The House version of the bill is 429 pages in length. Ironically even the tax simplification bills are longer than the original tax code and regulations from 1913. Both House and Senate versions of the bill reduce tax rates for individual and corporate taxpayers with subtle differences in the number of tax brackets and income thresholds for each tax bracket. They also either raise the estate tax exemption or phase out the estate tax all together. Both bills lower the corporate tax rates substantially for both corporate and pass-through entities. The exact brackets, thresholds and rules are beyond the scope of this analysis, but each bill is different enough that it has many anxious to see what the reconciliation process produces. However, if you stand back and you look objectively at this process, as I am sure the rest of the world has been able to do, this process has been nothing but pure theatre. Not only did Congress not simplify the tax code, but in all likelihood, they lengthened it. We used to joke when I was in Public Accounting that whenever Congress tried to simplify the code, it just meant more work for us! A great example of how this process really simplified nothing is how special interest groups managed to keep mortgage interest deductions, charitable and other itemized deductions in the tax code, while at the same time, Congress raised the Standard Deduction so fewer people would be able to deduct such costs. Although they raised the Standard Deduction to roughly $24,000 in both versions of the tax bill for Married Filing Joint taxpayers, they eliminated Personal Exemptions. For example, my family of four stands to deduct $16,200 in Personal Exemptions in 2017 that in 2018 will now part of the Standard Deduction. If you add, the 2017 Standard Deduction of $12,700 for married couples filing jointly to the Personal Exemptions and deduct $24,000, my family actually stands to lose $4,900 in deductions in 2018. In the past, we have also benefited from using itemized deductions to cut our tax bill, but with the new higher Standard Deduction, that is now unlikely in most years. This means I am likely to have higher taxable income in the future before applying the lower tax rates. Just a quick back of the napkin calculation based on 2017 projected income did show I stand to possibly save $300 - $500 in taxes based solely on the lower tax rates and brackets, but it was nowhere near the $2,200 that the Tax Foundation estimated I could save. Now, I am a past Certified Public Accountant so these kinds of calculations are quite simple for me, but how many of us have my kind of tax knowledge? Even with all my past knowledge, there is much in the tax code that I either do not know or would be hard pressed to apply. Truth be told, why do we need this kind complexity? What’s wrong with a 400-page tax code (and regulations) like in 1913 where I would guess most taxpayers understood most of its provisions. Unlike now where you need a team of professionals just to navigate the annual filing requirements. Think about how much more productive we could be if we were just focused on providing the best service or product possible and not spending and an estimated 8.9 billion hours and $409 billion as a country complying with the tax code, according to the Tax Foundation? As much as we can dream of a slimmer tax code, the reality is that the length of the federal tax code and regulations have grown steadily over the past sixty years. In 1955, the tax code and regulations were a mere 1.4 million words in length. Since then, they have grown at a pace of about 144,500 words per year. Where today the federal tax code is roughly six times as long as it was in 1955, while federal tax regulations are about 2.5 times as long as you can see in the chart below. Washington just doesn’t seem to have the will to actually simplify our tax system and code. It is obvious to most that special interest groups and corporate lobbyists control a large portion of our elected officials and thus what does or does not happen to our tax code.

Obviously, the only thing one can do is fight fire with fire! That is dig into this mammoth tax code and find the advantages that allow you to prosper while less savvy persons pay more than they probably need to or should! This is something we help our clients do every day. In fact, I issued a Tax Planning Alert just a few days ago to our affluent clients on a couple of simple suggestions that struck us about the recently passed House and Senate bills. When these House and Senate bills are reconciled and signed into law, I believe there will even be more opportunities to save valuable tax dollars just by arranging your business or investment affairs in such a way as to minimize future tax drag. As famed author Robert Kiyosaki likes to say, “it’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.” We can help you keep more, make it work harder for you and preserve it for multiple generations! Schedule your free consultation today!

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |