|

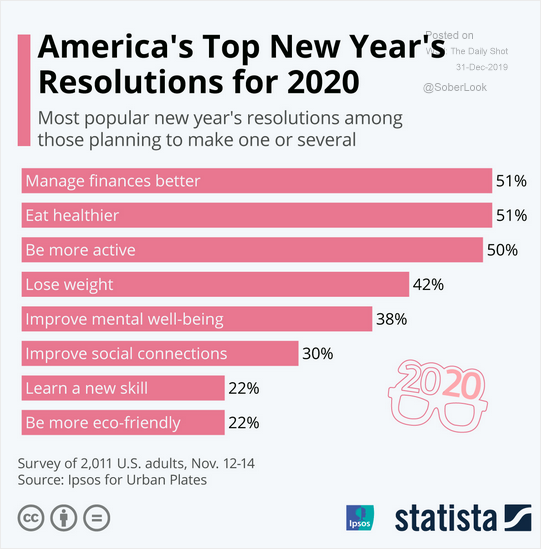

It’s the New Year, time to turn the page on another set of resolutions. It seems to me that every New Year should not be about the resolutions, but how long we stayed at the resolutions. I would guess as a society that the time we stay with those resolutions gets shorter with each passing year. This top New Year’s resolutions for 2020, according to Statista, look almost the same as last years. Or are they last years? What is interesting is the frequency of searches on Google for many of these resolutions. Can you see a pattern? These searches definitely do not persist. I think we can all agree on that!

It appears the majority of U.S. Adults according to this research want to manage their finances better, but you also noticed it was not one of the top Google search results! Why is it this one resolution seems to be at or near the top year after year? I would suggest it is because we Americans fail to power through and get things done (on average). Here is a great example. My twenty-year-old daughter is home from college for winter break. She leaves to study abroad in Italy in one week. She is nervous she is not prepared, and she has good reason to be nervous. Instead of powering through and getting better prepared, she keeps putting off the things she knows she must do for that trip, while instead spending time watching YouTube videos and shopping for things, she does not really need nor want. Now there is nothing wrong with the latter, but when the trip of a lifetime is fast approaching, and you have yet to figure out how your budget or even if you have enough money for the trip, there is a problem. She has no checklist of those items that you still need to be done and a date that each item needs to be accomplished. She is an organizational mess! Thankfully, her dear old dad sat down with her and help her with her budget. I also had to help her develop that to do list with definitive due dates. Now on a daily basis, her mother and I must remind her to keep at it or she inevitably drift back into her bad habits. This is not uncommon behavior in my experience. In fact, this is something we see everyday at InTrust Advisors with our family office clients. I am not sure everyone is wired to power through. Many cannot get out of their own way, as is the case with my youngest daughter. In the case of our clients, we facilitate, so they can get financial things done. It is what we do and strangely one of the reasons we get paid. So, being it’s a new year and this is essentially what we do, I thought it the perfect time to give you my seven ways to power through and get things done. 1. Make a list and prioritize This is a common recommendation that really does work. It’s essentially a “to do” list sorted by priorities, with a target completion date and an assignee. You can use a yellow pad or an online tool like Asana but getting organized is the first step to financial freedom. Brainstorm everything you need to do (example, hire an advisor) and then arrange them in the logical order they need to be completed. Add accountability by assigning the work to a specific spouse or person with a very specific target due date. 2. Delegate A key to getting more done is delegating. Our clients essentially delegate these tasks to us because (1) they can afford too, (2) they would rather spend their time elsewhere, and (3) it is not their gifting, but it is ours. I myself then delegate to our virtual staff to get more done. As a recovering one-man band and “getter done machine,” this is not an easily learned behavior, but with the right team you can accomplish more in a shorter period! 3. Set Aside Time Of course, a brilliantly constructed to do list and no time to accomplish those items is a big problem. Only bite off what you reasonably believe you can accomplish. If you need help, see number 2 above or shrink your list. 4. No pain, no gain Anything worth doing is worth doing right and sometimes it involves pain. I spent a good part of the holidays fixing the work of a former assistant and a larger financial services provider who both failed to do the work properly. Yes, it was unpleasant. However, when these financials are cleaner come summer and my team and I are wrestling with tax reconciliations and looming tax deadlines for supplying this information to our cadre of CPAs, it will be time well spent! 5. Focus on the positive outcome Attitude is everything. If you focus on the benefits of the positive outcome, it makes the work and the pain of pushing through worth the work. In the example above of fixing company financials for a client, the benefits I focused on were accurate financials for the client, better decision making, a smoother summer and the ability to take some time off this summer to go visit our oldest daughter in Boston, who is a first-year law student at BU. I don’t want to be frantically trying to fix these financials (which were a mess) with a looming deadline and an inability to take some time off come summer, so I sacrificed some time now for the positive outcome or reward later. 6. Celebrate the completion Here is one they teach you in sales school, celebrate the victories. You finish having your attorney revise your revocable trusts and sign the revised paperwork, now it is time to celebrate! Whether that means it’s Miller Time or just that it earned you some “me time,” you must celebrate the wins! 7. Rinse and Repeat The final step is exactly what you read on the back of your favorite shampoo bottle:” rinse and repeat.” In other words, regain your strength and tackle the next item on the list. Accomplishing great things is about taking a series of small steps over time and with regularity! That is why so many New Year’s resolutions fail, the steps are too large, and the regularity becomes too difficult to maintain. Don’t fall into this trap! I hope this list of seven ways to power through and get things done has been helpful. If you have other suggestions or ideas, let us know in the comment section below or on our blog.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |