|

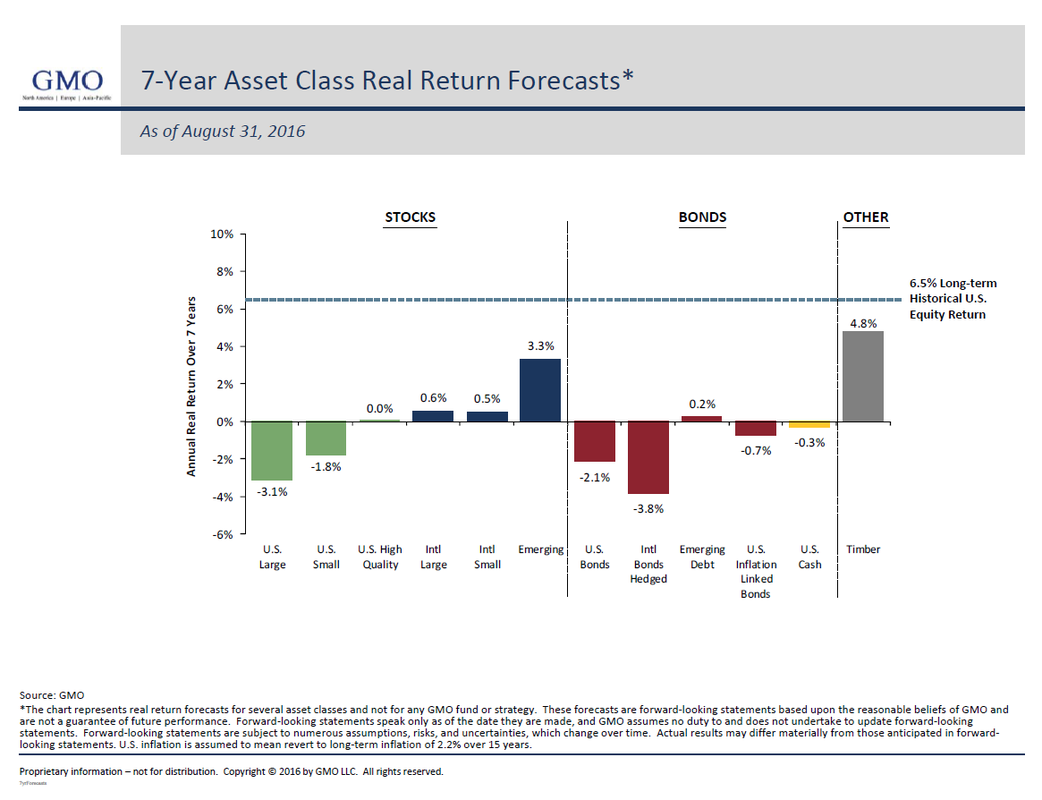

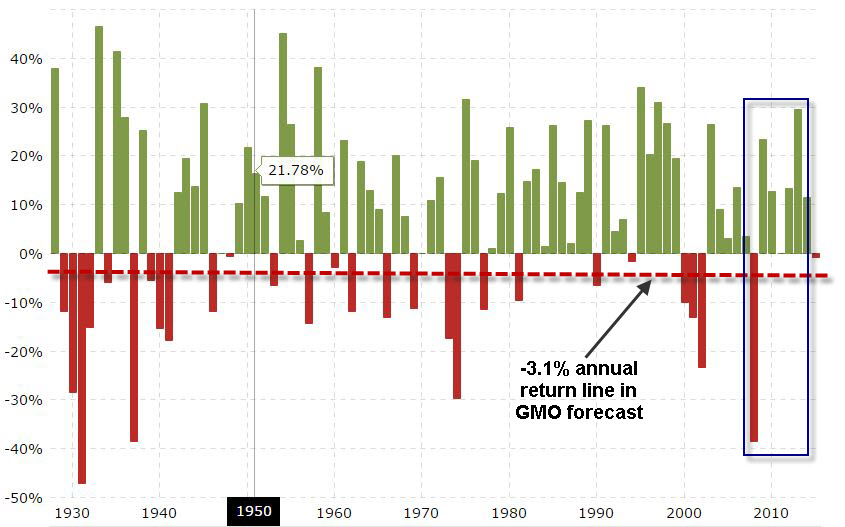

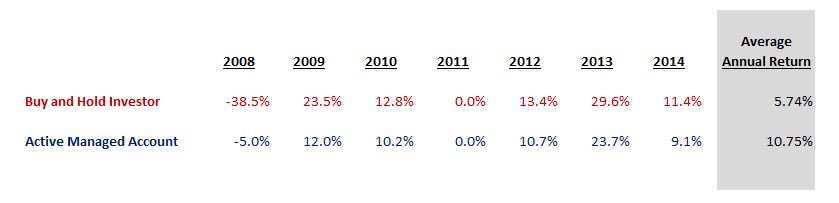

My good friend, Rob Robbins at Franklin Templeton Investments, sent me the Real Return Forecast below from GMO. At first blush it is pretty negative! What is obvious is that investors are going to have to accept higher volatility in such asset classes as international or emerging markets if they expect to get any kind of positive return over the next 7 years if GMO is correct. This forecast however has two glaring weaknesses in our opinion. Those weaknesses are that it assumes: 1) that returns are stable over that 7 year period, and 2) that you are a "buy and hold" investor. So let me address each weakness separately. Stable Returns First, when investors think about forecasts like this they tend to assume that the return stream will be stable, i.e., the same every year. However, the truth is that markets are volatile and returns are likewise volatile. We can see that returns are volatile, below, in this chart of annual S&P 500 performance courtesy of Macrotrends.net. If we take it one step further and overlay GMO's expected returns for U.S. Large (dotted red line) over this chart, you can see that there will likely be up and down years throughout the forecast period. Pick a period of time, like the one I highlighted in the blue box, and you can see there are years you will make money and likely years you will give back returns. This Forecast Is For Buy and Hold Investors The second point I would like to make is the GMO returns assume that you are buying and holding your investments during this forecast period. However, if you are a client of ours that is not what you will be doing. So lets assume for a moment that we have a replay of the 2008 - 2014 period. What would that possibly look like for a client with an actively managed account assuming a 5% loss in 2008 while getting out of the markets post a bear market signal, a 12% return in 2009 due to a late signal to get back in the market and only 80% the returns of the S&P 500 in the balance of the years due to excess Central Bank intervention? Sound familiar? Here is what that looks like: Historical S&P 500 Index Returns (Buy and Hold) vs. Hypothetical Actively Managed Account ReturnsA phenomena called "Recency Bias" has most investors up in arms about actively managed strategies, but if we include 2008 in this hypothetical analysis, you can see that if we can avoid the big down period (which if you are honest with yourselves you know is coming), that even with earning less return in 2009 - 2014 years you still come out ahead in terms of an annual return (10.75% vs. 5.74%). Now let take a SWAG (scientific wild a_s guess) at what market returns may look like in the next seven years under GMO's forecast. Bear in mind this is just a hypothetical guess and it is possible that big down years are replaced by a series of smaller loss years or the big loss year is pushed farther out by even more Central Bank intervention. Hypothetical S&P 500 Index Returns (Buy and Hold) vs. Hypothetical Actively Managed Account ReturnsWhat we see here in this SWAG is that while the buy and hold investor did realize a negative seven year return in the S&P 500, the actively managed account did much better because he/she avoided the hypothetical big draw downs in 2017 and 2018. The actively managed account was slow to respond to a rally in 2019 and made only 80% of what the buy and hold investor did in 2020 - 2023 period but still came out substantially ahead. The Moral Of This Story The moral of this story is that even if you are one of the many persons out there looking feverishly for positive returns and are turned off by forecasts like GMO's showing the next 5-10 years will be low return years, there is hope! The solution is not what has been working so well since the 2009 bottom (buying and holding and indexes), but what has not been working half as well and that is an actively managed approach. Investing is cyclical and every type investment strategy has its day in the sun. You have to figure that the buying and holding of index is probably in the 8th or 9th inning if it were a baseball game. In the years to come, the key will be to avoid the big down periods and just do "ok" in the up markets. The result will be positive returns. Maybe not what we have seen in the past but "ok" positive returns. If we then get smart and add exposure in the areas of the market highlighted by GMO as potential outperforming asset classes maybe that return profile improves further. This is NOT the time to go chase some other investment options such as direct lending or commercial bridge loans or even the next tulip mania, this is the time to change how you approach the markets because the cycle has to be near an end. I certainly don't want to disparage diversifying, but right now in this market everything is in bubble territory and the more you stretch for return, the more likely are you to get your head handed to you on a platter when this market finally hits the skids. So let us know if we can help you position for what is likely coming. We offer a Free Second Opinion - click here to sign up. Disclosures:

Past performance is not an indication of future performance. The S&P 500 is a capitalization weighted index of the 500 leading companies from leading industries of the U.S. economy. It represents a broad cross-section of the U.S. equity market, including stocks traded on the NYSE, Amex and Nasdaq.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |