|

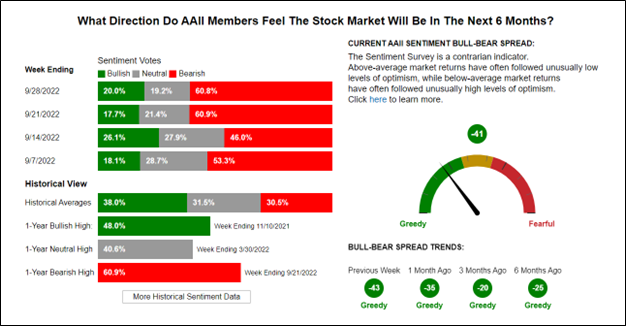

You would not know it from our portfolio positioning, but we believe the markets could bounce higher into the holidays. Why do we believe this? Market participants are too bearish on the equity markets. When sentiment gets this negative (see AAIA chart of Bearish Sentiment below), Mrs. Market tends to do what it needs to do to fool the largest number of market participants. In this case, that would be a significant market bounce. You can see that negative sentiment has never been this high in the twenty years that this survey has been taken by AAII. You can also see below that this pegs those investors in the Greedy camp, which is a dangerous place to be! Courtesy of the American Association of Individual Investors. This means too many traders/investors are on the same side of the trade. There must be bulls and bears in roughly equal numbers to have a market. Risk shifts to extremes when that balance shifts to one side or the other (i.e., too many bears or too many bulls). I have to admit we are part of the traders on the same side of the boat just because the market seems unable to find solid footing for a sustained rally that would justify a shift in positioning. We are now trading at or below the June lows and we speculate that there may be another 3% to 4% downside until we potentially find an areas of support. Again, this is just a guess at this point, but we believe a rally, like the June rally is possible into the seasonally strong months starting in mid-October through December. If that is the case, we will have to do some quick repositioning when that reversal does come to participate in that bear market rally.

Note, we are not saying the bear market is over, just that it is due for a rally that wipes out excess bearishness and probably brings excess bullishness in its place, just like at the August top. Good luck out there! Let us know if we can help you ride out these difficult markets and economic times with either better financial planning or better investment management solutions.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |