|

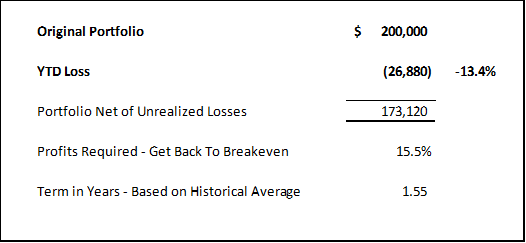

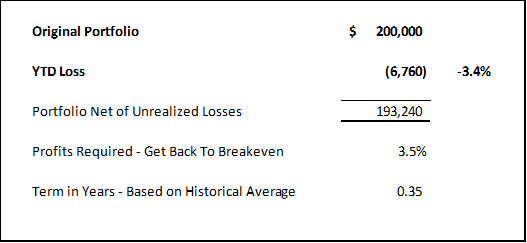

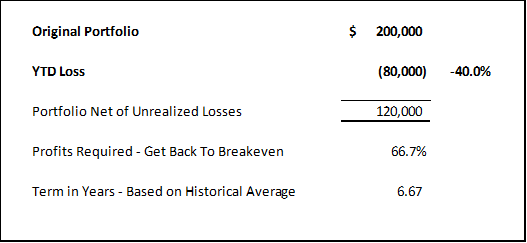

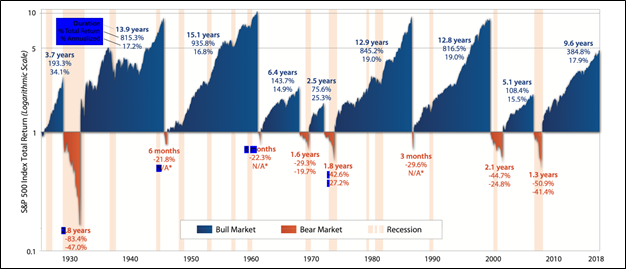

This has been a challenging year for investors. No one likes to see their portfolio decline even investors with really long horizons. It is this same distaste for losses that leads to excess fear during market declines and bad decision making, such as selling at the lows and then buying again into short-covering Bear Market bounces. The simple truth for all but the most nimble and skilled of investors is that a Bear Market is no fun! Yes, there are some managers who do well in a Bear Market, but they are a small number and typically are frequent traders or just happen to specialize in the one area the market that is outperforming, such as commodities and crude oil this cycle. What you don’t see is the years that that manager underperformed waiting patiently (or not so patiently) for their day in the sun. For most of us that are not traders, our goal in a Bear Market should be to lose as little as possible. This will then allow us to recover much faster when the smoke clears, the sun again rises and markets start to trend upward again, which they will. Let’s take a look at an example of why this is so important. Here are the assumptions in this example. First, our example portfolio is $200,000 in value at the end of last year. The year-to-date loss in the S&P 500 index is -13.44% on a price basis through May 27th and finally that the average S&P 500 Index Return over the last 50 years is +10% (per Investopedia). If we apply the year-to-date loss to the original portfolio value of $200,000 at year end, we have a portfolio value of $173,120 today. To get back to breakeven, the portfolio’s owner must earn +15.5% on the portfolio value today and in historical terms, it should take about 1.5 years to get back to breakeven. This is not so bad, but the loss was much worse just a few days ago and I would argue we are probably a long ways from the end of this Bear Market based on historical average returns and lengths in months. For comparison’s sake, let’s take the same assumptions accept the investor had all their money in the HFRX Global Equity Hedged Index (i.e., a representative of the overall hedge fund universe globally) and was down less at just -3.38% through May 27th. If we apply the year-to-date loss to the original portfolio value of $200,000 at year end, we have a portfolio value of $193,240 today. To get back to breakeven, the portfolio’s owner must earn just +3.5% on the portfolio value today and in historical terms, it should take about .35 years to get back to breakeven assuming they moved all their funds into the S&P 500 at the bottom of that decline. It would likely be a longer recovery period if the funds remained in the HFRX Global Equity Hedged Index based on historical returns, but not a lot longer. So, can you see the difference? The bigger the loss, the longer the recovery! .35 years vs. a recovery of 1.55 years. Which recovery would you rather have? I mentioned in the open that I thought this Bear Market has farther to run. So, let’s assume now the market drops -40% and all other variables are identical. If we apply -40% loss to the original portfolio value of $200,000 at year end, we have a portfolio value of $120,000. To get back to breakeven, the portfolio’s owner must earn +66.7% on the portfolio value net of losses and in historical terms, it should take about 6.67 years to get back to breakeven. Ouch! Now let’s put this in perspective, 6.67 years is roughly 75% of the length of the average Bull Market. Who wants to wait that long to get back to breakeven? I would even make the case that the last 30 years of liquidity driven markets have distorted that average Bull Market length. A return to normal liquidity should result in shorter Bull Market cycles, but I digress. Now the really bad news! The average Bear Market has lasted about 1.4 years and resulted in a cumulative loss of -41% (per Cascade Financial Strategies).

We are now five months into this current Bear Market and, if history is any guide, we have at least eleven months to go and another -27.6% of possible downside. Not a pretty picture! What is the answer you say? The answer is to lose less. The answer is to utilize managers, such as InTrust Advisors, that raise cash, hedge or risk manage portfolios to minimize the damage from the Bear Market. As I mentioned early in this post, this is not easy, but I believe we have entered a cyclical period where just “buying and holding” will be dangerous to both your portfolio and financial plans! The easy money was made over the last 30-40 years, but with inflation spiking, debt at unsustainable levels, interest rates shifting into an upward trend and record valuations, it would stand to reason that eventually we need to sort all this out. The result is likely a period of greater volatility and lower returns for all investors, especially those (in my opinion) that just “buy and hold.” If we can help you lose less in this Bear Market and protect portfolio principal, while managing risk, please let us know. We offer a free portfolio review. We can also help you take a look at your financial plans and help get you back on track, assuming you are now off track.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |