|

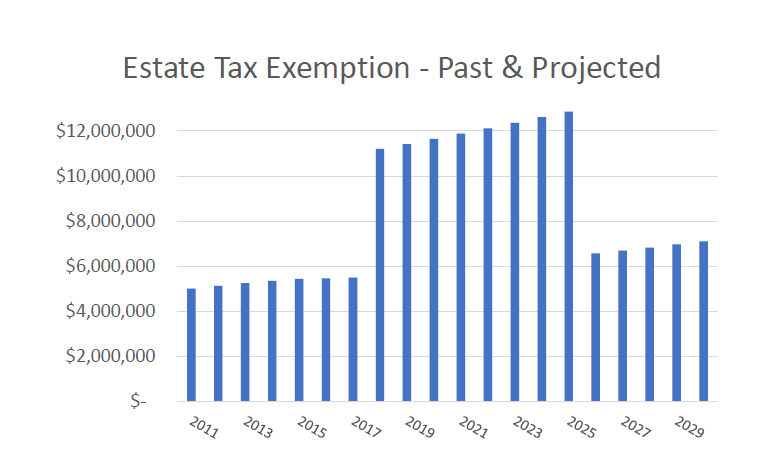

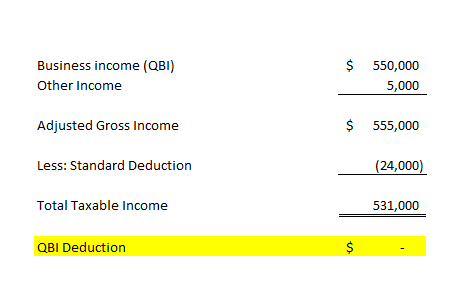

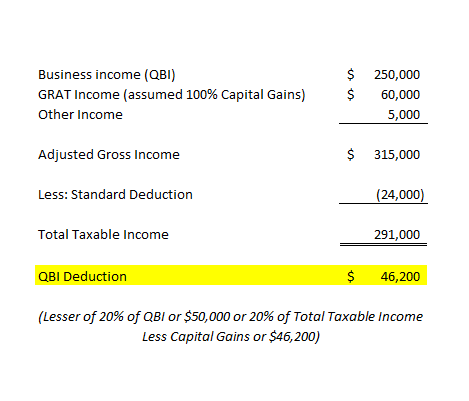

Maybe you have heard of the phrase “there is no such thing as a free lunch?” It was first used in part by Fiorello La Guardia, on becoming mayor of New York in 1933, when he said “È finita la cuccagna!", meaning "Cockaigne is finished" or, more loosely, "No more free lunch"; in this context "free lunch" refers to graft and corruption, according to wikipedia.org. His catch phrase later morphed into the colloquialism that we know today that “there is no such thing as a free lunch.” If fact, a Columbia Law Review of all places used this phrase in the Owlwin Daily Register in 1945. Most of us would agree that “there is no such thing as a free lunch!” We have most likely been tricked at least once in our lifetimes into jumping into something that seemed free, only to find out it is anything but free! I can remember a certain free vacation weekend that my wife and I took where all we had to do was attend a short timeshare presentation. As we learned later, it was very hard to walk out on that presentation without committing to purchase something. I am glad to say, we managed to be one of the lucky few to get out without signing our lives away, but we learned a valuable lesson from that experience that such vacations were anything but free. So what is your response when I tell you that Congress, of all places, has granted each of us a free lunch with its recent passage of the Tax Cut and Jobs Act of 2017? Maybe you were as skeptical as I, but its true! Yes, Congress granted you a free lunch by expanding the estate tax exemption from $5.5 million in 2017 to $11 million in 2018 through 2025. I can already hear you grumbling, “but isn’t that just for the rich?” Well yes, and no! Obviously, for those with estates with assets greater than $5.5 million ($11 million for a couple), this is a wonderful thing and will potentially save their heirs millions in estate taxes. But it also affects all of us. Here is how. The estate tax exemption is not permanent! It sunsets in 2025 back to inflation adjusted 2017 levels, as if this tax act was never existed. Many believe that Congress will never find the votes to make this exemption increase permanent, so you essentially have seven years to use this “funny money” under a “use it or lose it” scenario. For the ultrawealthy, they will do what they do best, hire the best advisers to help them plan the best way to use this added exemption before it sunsets. Of course, we can help with this. The real jewel here is for anyone who owns a business that might generate income in excess of $315,000 (married filing jointly). Why $315,000? That is the threshhold at which a complex series of calculations occur that either phase out (for service businesses) or potentially limit (for all other businesses) the 20% Pass-Through Deduction created under the Tax Cut and Jobs Act of 2017 that allows such business owners to claim a deduction equal to 20% of domestic qualified business income or QBI. A full discussion of this QBI calculation is beyond the scope of this article, but needless to say it behooves most high earners to stay under the $315,000 threshhold and to claim the full 20% QBI deduction. So now let me tie the estate exemption in with the Pass-Through deduction. The new game in town is likely to become using the ”funny money” (higher estate tax exemption) and vehicles like Charitable Remainder Trusts or Grantor Retained Annuity Trusts to make gift tax free transfers and smooth income to stay under the $315,000 threshold. In other words, it’s all income tax avoidance driven, not estate driven! Let me now give you an example: Joe, married and a 33.33% owner in Dental Inc., has $550,000 in pass-through net service business income in 2018. Joe and his non-working spouse have $5,000 of other income and expect to take the new $24,000 standard deduction in 2018. Based on these facts, below is a summary of Joe’s QBI deduction in 2018: As you can see the QBI deduction is completely phased out because Joe is in a service business and his income is above the phase out range for married taxpayers of $315,000 to $415,000. However, what if Joe’s business income instead was $250,000 of ordinary income and $300,000 from the one-time sale of an ancillary business unit. What if Joe was unable to reach agreement on an installment sale to spread his income with the potential buyer. Instead, he and his advisors decided to contributed the stock of this ancillary unit to a Grantor Retained Annuity Trust (GRAT) utilizing some of his “funny money” estate tax exemption to cover the prospective gift tax on the transaction. The stock would be then sold in the GRAT and Joe would instead receive back $60,000 per year over five years from this trust, with the balance going to his children as the beneficiaries of the trust. In this case, Joe’s QBI deduction in 2018 would look like the following: With the QBI deduction, Joe should realized $46,200 in reduced income in 2018 and potentially the four years thereafter just from proper planning. He also used some of his “funny money” estate tax exemption to cover the transfer tax on the difference between the present value annuity back to him and the fair value of the gift to the GRAT on the date of transfer.

If Joe had a charitable inclination, he could have used a Charitable Remainder Trust or any number of other planning techniques. The key concept here is that Joe and his advisors were smart enough to realize the benefit of this increased, but temporary estate tax exemption in helping smooth his income so he could fully capitalize on the new 20% flow-through deduction and lower his taxable income. So maybe there is such a thing as a free lunch? If there is, it came in the form of this Tax Cut and Jobs Act of 2017! Of course, this is purely a simplified, hypothetical example. We recommend that you consult your tax professional to make sure these planning opportunities are right for you and fit your specific circumstances. We can help you keep more, make it work harder for you and preserve it for multiple generations! Schedule your free consultation today

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |