|

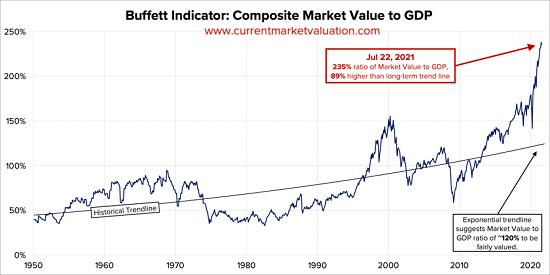

Can you remember the time as a kid, or even with your kids today, that you purchased a container of bubble solution? The idea was simple, dip the applicator into the bottle, pull it out quickly and then blow into the applicator hole and watch the bubbles appear. Oh, the joy of blowing bubbles and then watching them settle everywhere! Unfortunately, every bubble popped! It didn’t matter whether it was a little bubble, or the giant bubble produced by some kind of larger wand! They all popped! They either popped in air or popped hitting an object, like a blade of grass, but they all popped. It was just a matter of when, not if! The same can be said of economic bubbles, they all pop eventually. We saw the Dot.com bubble pop in 2000. The great recession bubble pop in 2007. Now it is just a matter of time until this one, “the mother of all bubbles,” pops. When it pops, watch out! I have written a lot over the years about this bubble! It has been a challenge for anyone but those willing to put their full faith in the Federal Reserve (the “Fed”) and “buy the dips.” The scary part is this is the only market many investment managers have ever seen. The type that goes up, never stays down, and that recovers almost instantaneously from any dips. In blogger Charles Hugh Smith’s recent Zero Hedge article entitled “The Moment Wall Street Has Been Waiting For: Retail Is All In”, he makes the case that this bubble has moved to a very dangerous stage, the “All-In” stage. This according to Mr. Smith is because up to this point, “the old hands on Wall Street have been wary of being bearish for one reason, and no, it's not the Federal Reserve, the old hands have been waiting for retail, the individual investor, to go all-in stocks. After thirteen long years, this moment has finally arrived: retail is all in.” He further makes the case that all you need to do is look at the investor sentiment, record margin debt levels and the Buffet Indicator (chart below) to see that we are at extremes. He makes the case that current valuations are “so extreme that the previous extreme in the 2000 dot-com bubble now looks modest in comparison.” Now Mr. Smith may have a point, but the critical thing about bubbles is they tend to go on much longer and go much further than most would ever imagine. Yes, we are thirteen years into this one, but does the Federal Reserve and our happily complicit officials in Washington have a choice, but to keep this one going through new spending programs, like the $1 trillion infrastructure bill now heading to the Senate, or the asset purchase programs in place by the Fed. In doing so, they are just blowing bigger and bigger bubbles. Ones that when they pop will hurt all but the nimblest of investors.

Charles Hugh Smith lists off a number of warning signs in his article that he believes to points to a possible crossroads for this current market bubble. Signs that are not new but happen at most tops. They include:

He wraps up the article by stating that these confident investors, the Robin Hood investors, do not realize one thing, they are “the marks and bag holders.” This market saga is not new! It happens over and over again, and Wall Street is a pro at drawing in retail investors who ultimately become overconfident, buy and hold or buy every dip, only to leave them holding the bag at the top of the market while they head for the exits. My friends, I would agree with Mr. Smith that we are approaching that proverbial “fork in the road” when markets top out and buying the dips no longer works. The question is not if, but like the bubbles you blew as a kid, when they pop! So how do I put a positive spin on this gloomy forecast? I would like to give you some simple ideas that might help you avoid holding the bag or being the bagman. They are not earthshattering, but they are tried and true!

Of course, we are here to help. If you would like to talk, just click here or give us a call.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |