|

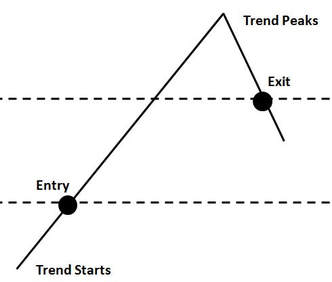

Shoot the fireworks and uncork the champagne, this current bull phase is now the second longest in history at 107 months! Our course everybody celebrates number two right? We’re #2! We’re #2! I am sure you heard this chant at the last Florida vs. Florida State game, right? (sarcasm) Think about it! The longest expansion in history was 120 months from March 1991 to March 2001. This current expansion has just slipped into second place in the history books at 107 months (106 months was the previous second best). How much longer can it goes is a great question to ask? However, the Gambler’s Fallacy (not that this is gambling after all its investing) is assuming previous results will change future results. As an example, “I have run this 50 times, so it must be likely to drop now.” And it really feels like it should be that way. But it's not any more likely on the 50th run or the 500th run. Are markets random as in the flipping of a coin or are they as much about the underlying fundamentals of a given time period or market? One could argue either way! I would personally argue it doesn’t matter. You take what the market wants to give you whether that is 120+ months and a new record long expansion cycle or 107 months and then straight off a cliff. Forecasting is a losers game! Instead, we propose you should be ready to react to confirmation that something has changed. This is the fundimental tenant of trend following, an investment strategy woven into every portfolio we run at InTrust Advisors. Trend following is agnostic as to the direction of the markets, up or down. In fact this chart could just as easily be inverted for the trend follower.

If you remember back to the last major bear market the thing that crippled most investors was indecision. Do I stay in or get out? Most investors just froze and did nothing and rode the market to its lows. Yes, it recovered, but it took five long years to do so! A great many trend followers instead had 30-50% positive performance years in 2007-2008. How would that have affected your portfolio? We have solutions to give you or your client’s a great chance to continue making money as long this market wants to keep setting endurance records. At the same time, we have the tools and experience to keep them from the worst of what may come at any flip of the coin! Why not schedule an appointment with us today?

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |