Will Passive Investors be Left Holding the Bag as a Possible Unintended Consequence of Fed Policy?7/25/2016 Last Saturday night I finally did it! I watched the movie "The Big Short." It was not as bad an experience as I had imagined. My family was even impressed how many of the players in this story I knew or had dealings with prior to the Great Recession of 2007. The most painful part was watching Dr. Michael Burry of Scion Capital LLC pony up on CDS settlements and the financial fraud on Wall Street that prevented his short investment from being fairly priced and from it making money initially. I too lived this nightmare! At the time, we ran a hedge fund of fund invested in a focused group of hedge fund managers. That fund included managers who had shorted the mortgage markets, just like Scion, and they too realized early losses. So much so that in 2007, these losses affected our overall portfolio performance so much so that our largest investor wanted out and I had to make the decision to shut down our fund. The next year of course, the mortgage markets tanked and I was vindicated. However, unlike Dr. Burry, I now was without a fund to profit from the decline. That's tough! So as I watched The Big Short, I couldn't help but think about the corollaries with our current stock market. Believe it or not there are a lot of corollaries! Here are just a few:

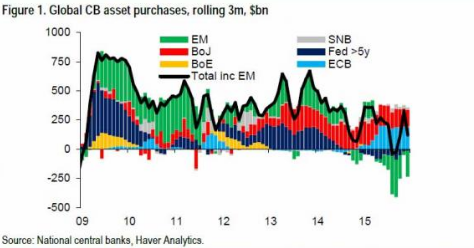

I am sure there are more, but these are the major themes I could come up with off the top of my head. Let's put aside the fact that this is going to end badly again for the borrower and the lenders (assuming they are not again bailed out), but how about the unintended consequences of such rampant greed and monetary policies? As as active investment manager, I can tell you one of the scariest unintended consequences I see is the rush to low cost, buy and hold or passive index strategies. Now don't get me wrong, I believe in low cost and passive strategies. However, we believe they should be combined with other ways of managing funds, such as actively managed strategies, to reduce overall portfolio risk. We call this mix of active and passive strategies a multi-disciplined portfolio. For us, it is not one or the other, but both! What I see is the wholesale dumping of active managers because quite frankly they have under-performed and the markets are being move by just one thing, Central Banks. Just look asset purchases over the most recent rolling 3 month periods since 2009: As you can plainly see the asset purchasers globally were the Central Banks. Professionals, like InTrust, had been selling or sitting with neutral positioning expecting markets to trade down as global growth has slowed and company earnings declined on a year over year basis, as seen below courtesy of Bloomberg. Instead of declining, global markets slowly melted upward on low volume and widespread rumors that the Bank of Japan was going to initiate "Helicopter Money," which they have since denied as even possible under their constitution.

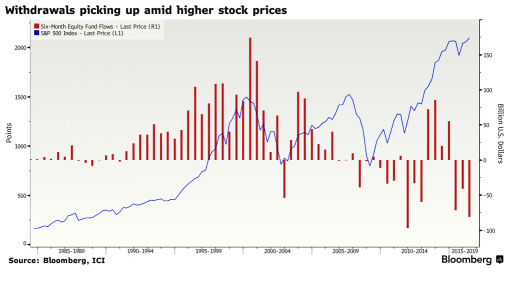

By the way, markets do not usually move up on declining volume. It is usually increasing volume that is the telltale sign of buying. Yet here we sit at new highs with deteriorating economic fundamentals across the globe and stocks shrugging off bad news on hopes of more Quantitative Easing or even "helicopter money". Not to sound bitter! We have adjusted our exposure on the market breakout and I love a good bull phase as much as the next manager. However, what I fear is the unintended consequences of this continued policy. As I alluded to earlier with every passing day more and more investors move to passive index strategies to lower their cost of management and ride the market wave. Essentially, they are putting their complete confidence in this grand Central Bank experiment in monetary policy. They are betting that continued money printing will prop up markets. But what if they are wrong? Buy and hold is just that buying and holding positions. What if the Central Banks have lured them into the markets and into strategies that do not have built in adequate risk management, beside the always dubious diversification of assets? What if the Central Banker's ultimate strategy is unload their portfolios on these unsuspecting roller coaster riders we call passive investors. Who will be left holding the bag? Let's say these investors are on top of their games and as the Central Banks start to shift to net sellers, they likewise start to sell. Can you imagine the downward pressure that will come upon stocks globally? I can tell you one thing, these passive investors, no matter how smart, likely do not have the tools available to them that active investors do to identify tops and adjust market exposure. Let alone flip short (inverse) and profit from such declines. This will be a blood bath! So now let me take it full circle, the movie "The Big Short" reminded me of the pain that I and other investors realized in the short-term on short positions or managers that took short positions on the mortgage markets. That pain however was nothing like the pain active managers (especially trend followers) have experienced over the last seven years of this Central Bank managed market. However, just like the big payoff in 2007-2008 for the managers who shorted the mortgage markets, the managers who can manage risk, market exposure and even profit from declining markets are going to clean up when this market finally does turn. The difficult part of all this for most Americans is that I fear you will be left holding the bag once again. As most of you will agree, another Great Recession and there is no way you are reaching your investment or retirement goals. So my suggestion to you is this: Make sure you, your investment managers or your adviser are managing downside stock market risk so that you can avoid being one of the millions of Americans who could be left holding the bag in the next crisis. You know it is coming! We all do if we are honest with ourselves. If we can help, please feel free to reach out to us.

4 Comments

Mike Nolan

7/28/2016 09:40:51 pm

So I made 18% on BofA. Can you tell me how I go about shorting it?

Reply

7/28/2016 10:21:26 pm

Mike, good for you on BofA!

Reply

I thought this was a pretty good tie in to this post from Cambiar Investors Q2 Market Commentary for 2016:

Reply

8/23/2016 08:32:27 am

It seems I cannot stop finding updates for this post. The latest from the Business Insider is a graphic showing the inflows into passive strategies vs. the outflows from active.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |